NIO is back on investors' radar as questions swirl around institutional money flows. Singapore's sovereign wealth fund, GIC, completely pulled out of its NIO position in 2023 after taking heavy losses. Now, there's talk that GIC - or funds like it - might be quietly preparing to get back in as the electric vehicle company gets closer to turning a profit.

GIC's NIO Journey: From Heavy Losses to Full Exit

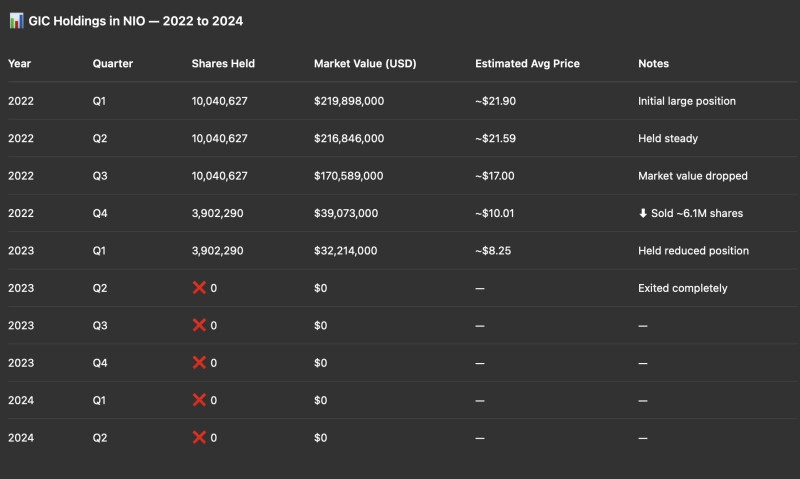

According to trader Pax, there are hints of quiet accumulation happening despite widespread retail investor caution. Looking at GIC's publicly disclosed positions reveals a dramatic shift in sentiment. In Q1 2022, GIC jumped in with over 10 million shares worth around $220 million, entering at roughly $21.90 per share.

Through Q2 and Q3 of that year, they held on even as the share price dropped and their position value fell to $170 million. By Q4 2022, GIC had dumped about 6.1 million shares, cutting their stake to under 4 million. When Q1 2023 rolled around and prices hit $8.25, their remaining position was worth just $32 million. From Q2 2023 forward, GIC was completely out - zero shares held through all of 2024. This timeline shows how even one of the world's biggest institutional investors can get burned badly before deciding to walk away entirely.

Chart Analysis: Signs of Accumulation

The holdings data tells an interesting story:

- Sharp selloffs lined up perfectly with major price crashes, meaning institutional selling made the drops even worse

- Current chatter focuses on the $6 level, where spoofing activity and order flow patterns hint at accumulation

- Investor sentiment is all over the place - retail traders remain skeptical, but there may be institutional money quietly building positions underneath

Why This Matters for NIO

This fresh wave of speculation comes as NIO pushes hard toward profitability. The company's ramping up EV deliveries across China and Europe, benefiting from strong Chinese government subsidies, and making real progress in battery swapping technology and autonomous driving systems. If institutions like GIC do circle back, it could give retail investors a confidence boost and help put a floor under the stock price.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov