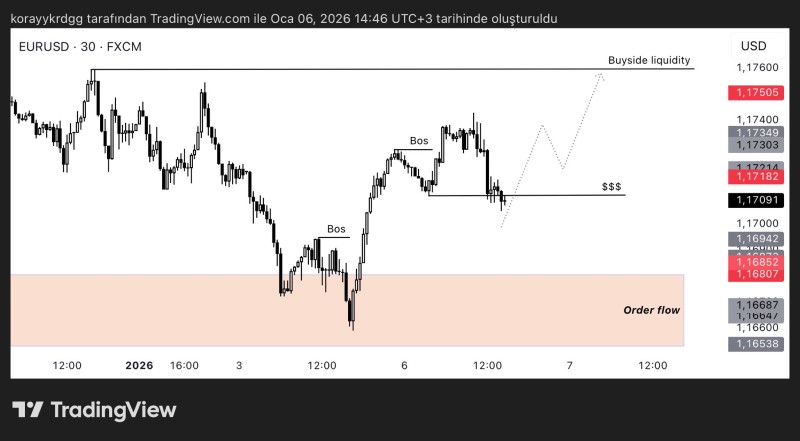

⬤ EUR/USD is holding firm above a crucial support region after recent price action set up what could be a continuation move higher. The pair has completed the necessary steps for a bullish scenario, and the outlook stays positive as long as it doesn't close below the orange order flow zone on the 4-hour chart. Right now, the pair is stabilizing around 1.1710 after pulling back from recent peaks.

⬤ The chart shows several break-of-structure signals that happened before the latest rally, pointing to shifts in market flow before the current consolidation. There's a key liquidity level marked with "$$$" sitting below current price – this area could act as support if tested. Above, there's a buyside liquidity target near 1.1760 that bulls are eyeing if the structure holds up.

⬤ Over the past few sessions, EUR/USD has pulled back slightly but it's still respecting higher-timeframe support, which suggests buyers are still in control as long as the key structure stays intact. The projected path shows a potential series of higher lows before another leg up toward that upper liquidity level around 1.1760. The pair is currently trading just above 1.1700, with nearby resistance in the 1.1730–1.1750 zone.

⬤ This setup matters because these order flow levels often dictate short-term direction in the currency market. As long as the pair holds above the defined support area, focus remains on the potential push toward buyside liquidity. But if it loses that zone on a closing basis, the bullish case weakens considerably. Traders watching EUR/USD will keep monitoring how price behaves around these structural levels to see if upward momentum can extend or if we'll see deeper consolidation instead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis