Chinese EV giant Nio Inc. (NYSE: NIO) just dropped some mixed news – they managed to boost May deliveries by 13.1% year-over-year to 23,231 vehicles, with their shiny new Firefly brand picking up steam. But here's the kicker: NIO stock is still getting hammered, sitting close to its yearly low after losing over 30% of its value in the past 12 months.

NIO's May Numbers Tell a Complicated Story

So here's what went down in May – Nio delivered 23,231 vehicles, which sounds pretty good when you stack it up against last year's numbers (that's a solid 13.1% jump). But here's where it gets interesting: they actually delivered fewer cars than they did in April, when they hit 23,900 vehicles. That's about a 2.8% dip month-over-month, and you know how the market feels about any hint of momentum slowing down.

Breaking down those May numbers, we've got the premium Nio brand doing most of the heavy lifting with 13,270 deliveries, while their family-friendly Onvo brand chipped in 6,281 units. But the real story here is Firefly – their new small premium EV brand that's targeting a completely different crowd. They managed to deliver 3,680 Firefly vehicles in May, which is pretty impressive considering they only started deliveries in April with a measly 231 units. That's some serious scaling right there, and it might just be the spark NIO stock needs to turn things around.

Firefly Could Be NIO's Secret Weapon

Let's talk about this Firefly launch because it's actually kind of a big deal. Nio officially rolled out this brand on April 19, and they wasted no time getting deliveries started in China that same month. The jump from 231 vehicles in April to 3,680 in May? That's not just growth – that's explosive growth that suggests Chinese consumers are actually digging what Firefly has to offer.

When you zoom out and look at the bigger picture, Nio's cumulative deliveries hit 760,789 vehicles by the end of May. Compare that to where they were this time last year (515,811 vehicles), and you're looking at a 47% increase. That's the kind of growth that usually gets investors excited, but NIO stock hasn't been getting much love lately. The market seems more focused on the red ink than the delivery numbers.

The Elephant in the Room: Those Brutal Losses

Now here's where things get ugly for NIO stock holders. Despite all this delivery growth, Nio is bleeding money like crazy. The fourth quarter of 2024 was particularly brutal – they posted a net loss of 7.1 billion yuan (that's about $1.3 billion USD) even though they delivered a record number of vehicles. Talk about a gut punch for anyone betting on NIO stock.

The full-year picture wasn't any prettier, with total losses hitting 22.4 billion yuan for 2024. These aren't just rounding errors – we're talking about massive losses that have investors wondering when (or if) this company will ever turn a profit. It's the classic EV industry dilemma: you can grow like crazy, but if you're losing money on every car, you've got a problem that delivery numbers alone can't fix.

NIO Stock Gets No Respect from the Market

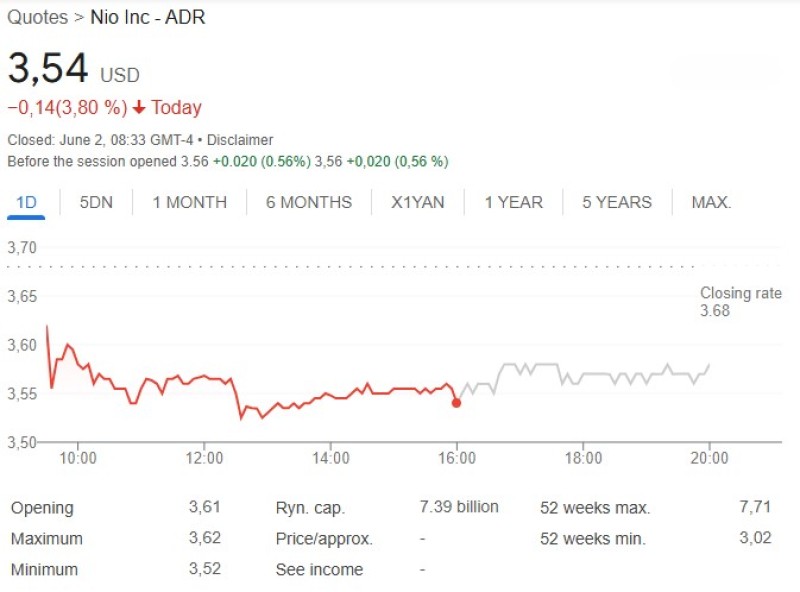

The market has been absolutely ruthless with NIO stock over the past year. Shares closed at $3.54 on Friday, which represents a crushing 31.6% drop over the past 12 months. To put that in perspective, NIO stock hit a peak of $7.56 back in October 2024 – so we're talking about investors losing more than half their money in just a few months.

Monday's trading session didn't help matters, with NIO stock dropping another $0.10 (that's 2.7%) to sit at $3.54 by 2 PM. That puts the stock dangerously close to its 52-week low of $3.21, and frankly, that's not where you want to be if you're trying to convince people you're the next Tesla. The company trades on three major exchanges – New York, Singapore, and Hong Kong – but that global presence hasn't done much to prop up the stock price.

The reality is that investors are getting tired of the "growth at any cost" story. They want to see a clear path to profitability, and right now, Nio's burning through cash faster than they can deliver vehicles. Sure, the Firefly brand looks promising, and those delivery numbers show the company isn't going anywhere anytime soon. But until Nio can figure out how to make money selling cars instead of just delivering more of them, NIO stock is probably going to keep struggling.

The next few quarters are going to be make-or-break time for this company. If Firefly can maintain its momentum and help improve the overall financial picture, we might see NIO stock start to recover. But if those losses keep piling up, even strong delivery numbers won't be enough to save it from further declines.

Peter Smith

Peter Smith

Peter Smith

Peter Smith