In a surprise move late Monday, NIO Inc. (NYSE: NIO) experienced a spike in trading activity just before the market closed, followed by an upward push in after-hours trading. The sharp volume burst has sparked debate among traders on whether a bullish reversal is on the horizon — or if it was simply a case of short covering.

Volume Spike Before Market Close

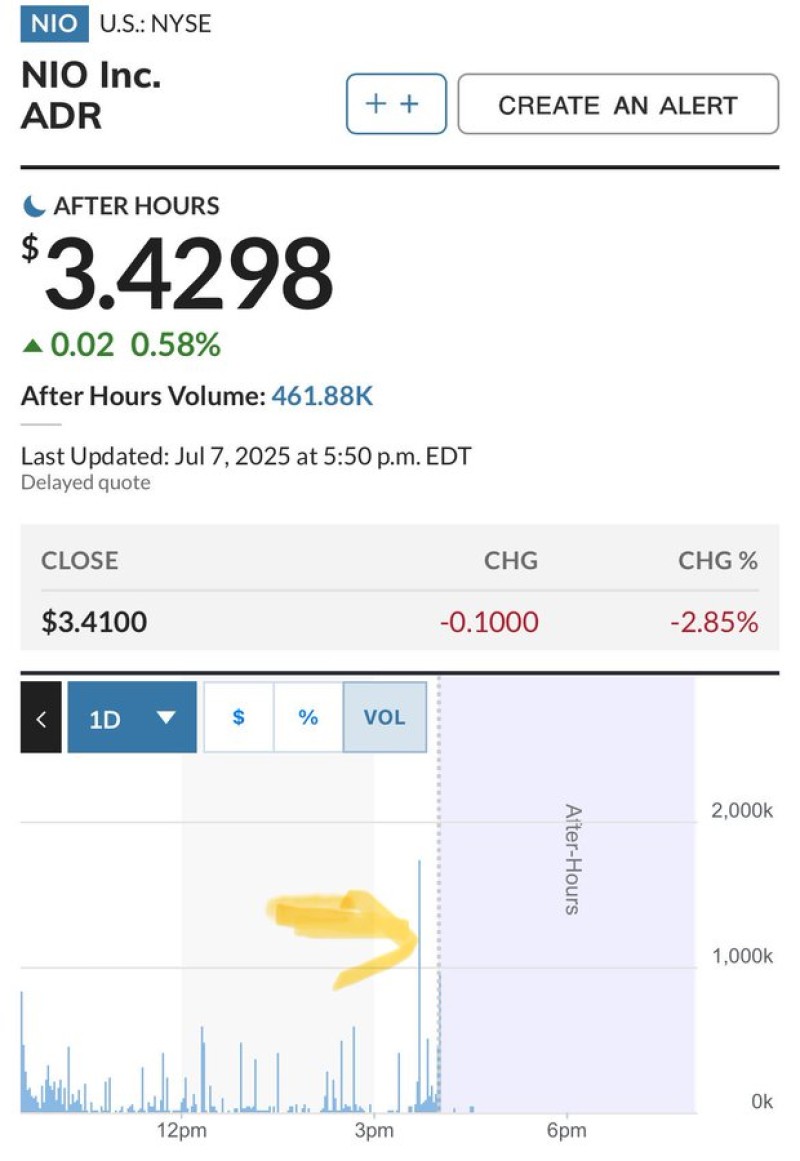

NIO saw a surge in volume around 3:00 p.m., shortly before the regular session ended. Total after-hours volume reached 461.88K shares, well above typical activity levels. The stock closed at $3.4100, marking a daily loss of -2.85%, but quickly recovered in extended trading to $3.4298, up 0.58%.

The volume bar highlighted in the chart suggests a large number of buy orders hit the tape in a short time frame, which could indicate institutional interest or algorithmic repositioning.

Buy Signal or Short Squeeze?

While some traders interpret the price jump to $3.4298 as a bullish signal and potential entry point, others are more cautious. The timing of the surge — right before the closing bell — raises questions about whether the move was driven by genuine buying interest or shorts rushing to cover.

With no immediate company news released, the after-hours rally could be short-lived unless further buying pressure materializes during the next session. Traders are watching closely for confirmation signals in pre-market trading.

Peter Smith

Peter Smith

Peter Smith

Peter Smith