The electric vehicle market continues evolving rapidly, with Chinese automaker NIO positioning itself uniquely through battery swapping infrastructure rather than traditional charging approaches. Recent technical analysis combined with operational developments suggests the company may be entering a significant growth phase.

Chart Analysis: Building Momentum

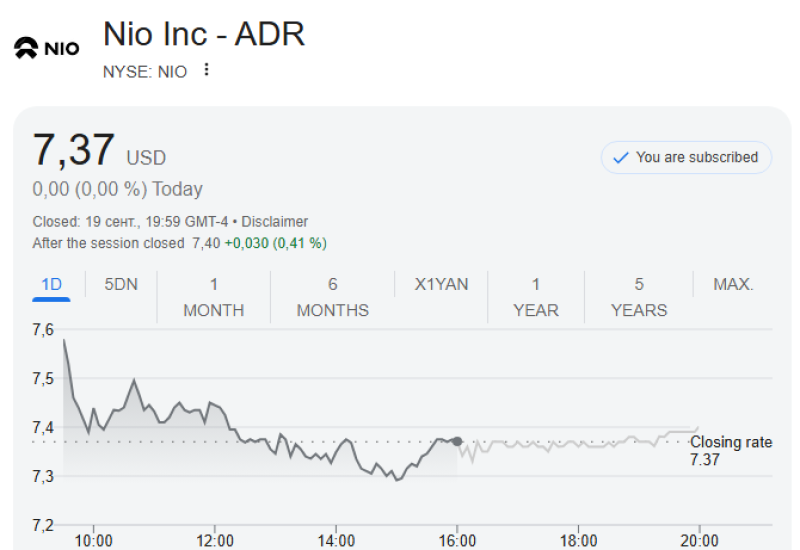

The technical picture for NIO shares reveals several encouraging signals. The stock has mounted a strong recovery from sub-$4 levels where clear buying opportunities emerged. We're seeing a classic breakout-retest-higher pattern supported by increased trading volume, suggesting genuine investor interest rather than speculative activity. Price targets of $8.59 and $10.45 align well with current market sentiment around the company's expansion plans, creating a technical framework that mirrors NIO's fundamental improvements.

Strategic Advantages

NIO's fifth-generation battery swapping stations represent more than incremental improvements—they're potentially game-changing infrastructure. The upgraded technology delivers faster, more reliable service while reducing operational complexity through collaborative station networks. This approach creates competitive advantages that few automakers have attempted at scale, giving NIO a potential moat in the crowded EV landscape.

Investment Implications

The upcoming Christmas trial launch offers real-world validation of NIO's technology in actual market conditions. Success could accelerate deployment across China and internationally, opening new revenue streams while strengthening customer loyalty. The combination of technical momentum and fundamental catalysts positions NIO for potential significant gains as the market recognizes both the immediate opportunity and long-term strategic value of their infrastructure-first approach.

Usman Salis

Usman Salis

Usman Salis

Usman Salis