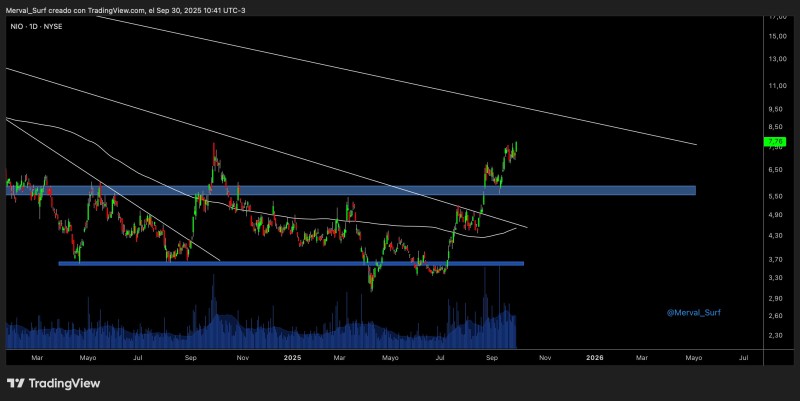

After grinding sideways for months, NIO just did something it hasn't managed in a while - it broke out. The Chinese EV maker pushed past the $5.50-$6.00 zone that had capped rallies all year, and now traders are watching one number: $9. T

The Technical Picture

hat's where the long-term downtrend line sits, and according to analyst Surfeando el Merval, it's the real test. Break through there, and suddenly $11 doesn't look crazy.

Here's what matters right now. The stock needs to crack $8.50 to $9.00 to flip the multi-month downtrend - that's the line connecting all the lower highs since the peak. If it does, the next stop is likely $11. On the downside, the old resistance around $5.50-$6.00 should now act as support, with a safety net at $4 if things get ugly. The volume surge backing this move isn't just retail FOMO either - institutional money appears to be getting involved, which changes the game.

Why NIO's Moving Now

China's throwing stimulus at the economy, and EV companies are catching a bid. Battery costs are dropping across the board, helping margins for the whole sector. More importantly, NIO's actually delivering cars at a pace that's keeping the growth story alive. When you combine policy support with improving fundamentals, you get the kind of setup that can sustain a rally beyond just a technical bounce.

The $9 level is everything. Clear it with volume, and NIO could be off to the races toward $11. Fail there, and we're probably looking at a pullback to $7.50 or even back down to retest $6 before the bulls try again. This isn't a stock you chase blindly - wait for the trendline break or a confirmed hold above $7.50 before adding exposure.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah