NIO's having a rough year. The Chinese EV maker's stock sits 94% below its all-time high, even though the company's actually doing some things right. They delivered 42,094 vehicles in Q1 2025 - that's a solid 40% jump from last year. Management thinks they'll hit 72,000-75,000 deliveries next quarter too.

But here's the thing: being down this much makes you wonder if Wall Street's missing something, or if there are real problems lurking beneath the surface.

NIO (NIO Inc.) Fights Back Against Tough Competition

NIO's throwing everything at the wall to see what sticks. They just launched four new models in May - the ES6, EC6, ET5, and ET5T. Plus, they've got their next-gen ES8 SUV coming in Q4.

The company's also betting big on sub-brands. ONVO targets everyday buyers, while Firefly goes after the smaller premium EV crowd. ONVO's first car, the L60, seems to be gaining some traction. Orders have been climbing since late April, and their second model (L90) starts deliveries in Q3.

Here's the problem though - NIO's still getting crushed by the competition. XPeng delivered 94,008 vehicles last quarter, and Li Auto sold 92,864. Meanwhile, NIO's sitting at just over 42,000. That's a pretty big gap to close.

NIO's Tech Could Be a Game-Changer

This is where things get interesting. NIO's rolling out some seriously cool tech with their World Model system. It lets cars make split-second decisions using raw sensor data - no maps needed. They've also got their own smart driving chip (NX9031) powering their flagship models.

But the real differentiator is their battery swap tech. Instead of waiting around for your car to charge, you just swap out the battery in minutes. They've got 3,408 swap stations worldwide and have done over 35 million swaps. It's actually pretty genius when you think about it.

NIO (NIO Inc.) Chases Profits But Still Bleeding Money

NIO knows they need to fix their money problems fast. They're cutting costs by combining R&D across all their brands and expect to slash admin expenses starting next quarter. The goal? Get those costs down to 10% of revenue by Q4.

Their vehicle margins hit 10.2% last quarter - better than the 9.2% from a year ago, but worse than Q4's 13.1%. Compare that to Li Auto's fat 19.8% margin, and you can see why investors aren't thrilled.

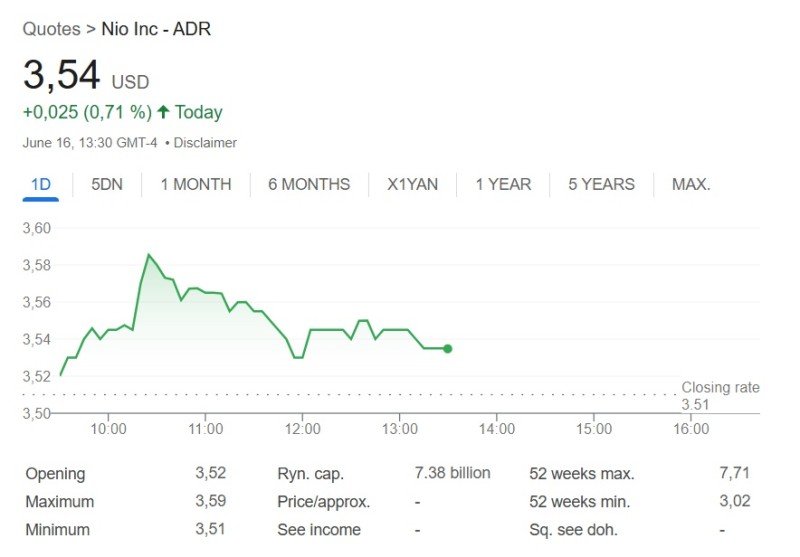

The bottom line? NIO's got some cool tech and growing sales, but they're still losing the profitability game. With China's EV price wars showing no signs of stopping, turning a profit won't be easy. At under $5 though, the stock might be worth a gamble if you believe in their long-term story.

Peter Smith

Peter Smith

Peter Smith

Peter Smith