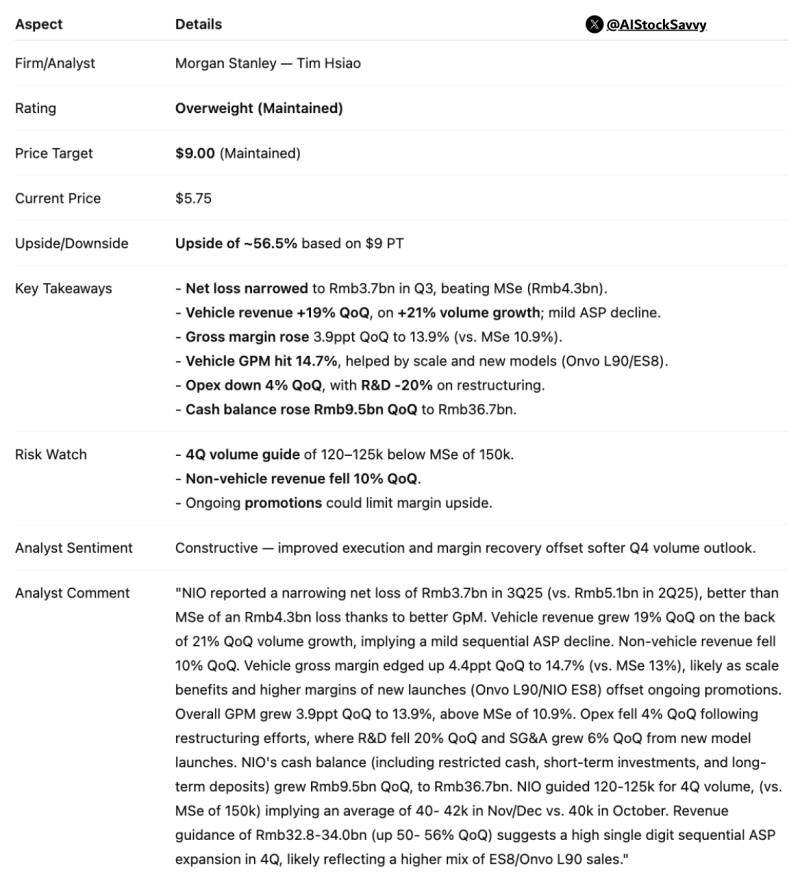

⬤ Morgan Stanley reaffirmed its confidence in NIO when analyst Tim Hsiao kept his Overweight rating and a $9 price target. The bank cited solid operational gains in Q3: losses shrank, vehicle revenue rose on higher sales plus the unchanged target implies room for the share price to climb. The move signals trust in NIO's trajectory despite short term delivery concerns.

⬤ In Q3 the net loss totaled 3.7 billion yuan, below the forecast 4.3 billion yuan. Vehicle revenue rose 19 percent quarter-over-quarter as deliveries grew 21 percent, even though average prices edged down. Gross margin improved by 3.9 points to 13.9 percent - vehicle margin reached 14.7 percent on scale effects and new models like the Onvo L90 but also ES8. Operating expenses fell 4 percent, with R&D down 20 percent amid restructuring. Cash increased by 9.5 billion yuan to 36.7 billion yuan, lifted by restricted cash, short term investments and long-term deposits.

⬤ Morgan Stanley highlighted items to watch. NIO guided Q4 deliveries at 120 000 - 125 000 units, below the bank's 150 000 forecast as well as non-vehicle revenue declined 10 percent. The analyst warned that continued promotions may squeeze margins near term - yet margins still rose sharply from Q2, helped by a richer mix of new ES8 and Onvo L90 vehicles.

⬤ The bank's steady view mirrors NIO's gradual but tangible turnaround. Q4 volume softness poses a risk - yet higher margins, tighter costs or a stronger product mix show clear progress. Those developments may influence how investors judge China's EV space as rivalry intensifies and manufacturers pursue profit as well as growth.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi