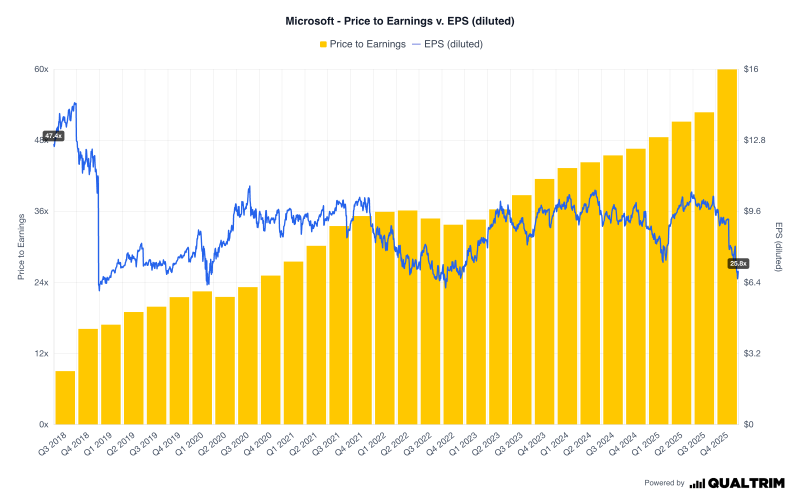

⬤ Microsoft (MSFT) delivered impressive financial results while its valuation stayed remarkably flat. The company posted +24% net income growth year over year and +39% Azure cloud revenue growth. The chart comparing price-to-earnings with diluted EPS shows profits climbing steadily even as valuation multiples dropped.

⬤ Diluted EPS grew consistently from mid-single digits in 2018 to nearly double-digit levels by 2025. But here's the interesting part: MSFT traded near 47x earnings at earlier peaks and now sits around 25.8x. That means profitability expanded way faster than the valuation multiple, leaving the stock priced similar to 2022 despite much stronger earnings.

⬤ This cloud expansion matches the steady EPS climb shown in the data. Instead of rising with earnings, the valuation multiple compressed as profits increased—creating a situation where MSFT earnings advanced but relative pricing normalized.

⬤ This highlights how company performance and valuation can split paths. Microsoft's case shows higher profits alongside a lower earnings multiple, reflecting how growth gets priced differently now compared to earlier periods. Strong fundamentals don't always mean expanding multiples—sometimes the market just recalibrates.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah