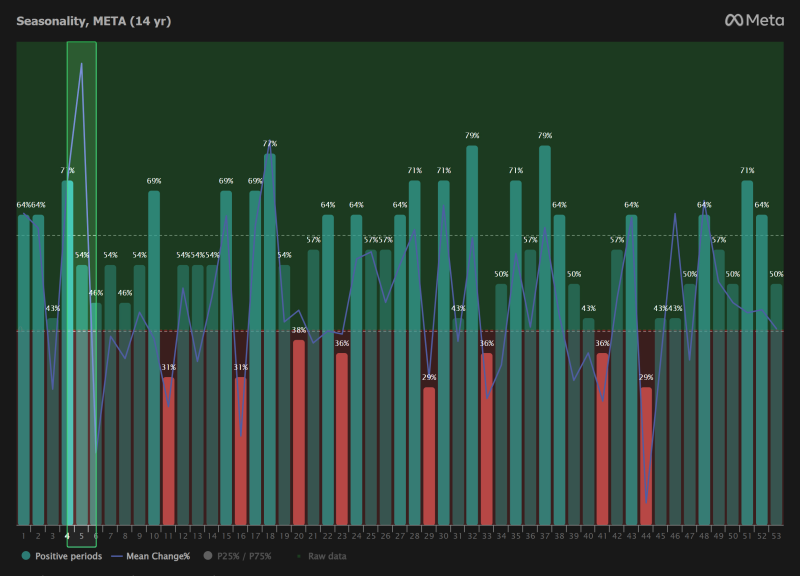

⬤ Meta Platforms is heading into what history suggests could be its best week of the year. Based on 14 years of seasonality data, META shares have averaged a 5.2% return during this specific earnings week, making it the strongest performing period across the entire annual calendar. The pattern isn't random—it's directly tied to how the market responds when Meta reports its quarterly results.

⬤ What makes this week particularly interesting isn't just the average gain, but how consistent it's been. The positive performance rate during this period ranks among the highest of the year, with readings regularly exceeding 70%. The data shows that price movements during earnings week have historically tilted upward far more often than not, pointing to a reliable seasonal trend rather than a few lucky quarters skewing the numbers.

⬤ Earnings drive this behavior. When Meta releases financial results, the market repricing that follows has repeatedly produced above-average weekly gains over the past decade and a half. This pattern has held up through different market environments, which suggests that investor positioning around earnings has become a predictable force in META's short-term price action during these windows.

⬤ For the broader market, this matters because Meta remains one of the heaviest weighted tech stocks. When META enters a historically strong earnings period, it can influence sector momentum and move major indexes. The consistency in the seasonality data reinforces how much earnings still matter as a catalyst—and how META continues to be a key mover when quarterly numbers hit the street.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah