Meta Platforms (NASDAQ: META) is lighting up options dashboards as traders bet on a potential rally before October 17. Data from Unusual Whales shows a clear bullish tilt in derivatives markets, even as some institutional players are selling the stock itself. This creates a classic tug-of-war that often precedes sharp price moves.

What the Options Market is Signaling

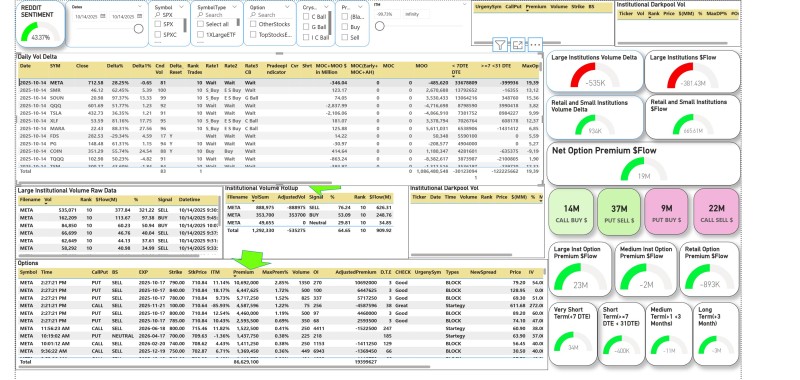

As @StockMarketMcro puts it: "the data does not lie." Net premium leans bullish. The aggregate option premium flow sits at +$19M, meaning traders paid more for upside exposure than downside protection. Large institutions specifically pushed +$23M into options premium, showing big players are willing to pay up for calls despite mixed signals in the underlying stock. Very short-dated flow (expiring within 7 days) added another +$34M, pointing to event-driven positioning right into the October 17 window.

Calls are winning the volume battle. Call purchases hit $14M versus just $9M in put buying. More telling is the $37M in put selling—functionally a bullish stance, as traders pocket premium betting against a major drop. Call selling came in at $22M, which can represent covered call programs, but in context still leaves the overall skew pointed higher.

Equity flows tell two stories. Large institutions sold on the equity side, moving roughly –535K shares and –$381M in flow, suggesting some distribution from hedge funds or asset managers. Meanwhile, retail and smaller institutions bought the dip to the tune of +$666M. The institutional volume rollup shows pockets of bullish activity concentrated in options, meaning even funds selling stock are buying upside exposure through derivatives.

Why Bulls Think META Can Run

Meta's AI and efficiency story continues to gain traction. Progress on Llama models, improvements to the ad platform, and operating leverage have kept the "AI plus margin discipline" narrative alive. The heavy concentration of short-dated call flow suggests traders expect a move before or around October 17—likely tied to guidance updates, product announcements, or broader sector catalysts. META has consistently been a high-beta, high-liquidity leader in tech, and when options skew turns positive with meaningful premium backing it, follow-through moves tend to materialize.

Peter Smith

Peter Smith

Peter Smith

Peter Smith