⬤ Meta Platforms continues grabbing attention for its valuation story. Right now the stock trades at roughly 25 times forward earnings. With Wall Street expecting earnings per share to hit $33.21 by 2027, that puts the stock on track toward $830. We're looking at about 12% compound annual growth and a potential 24% return over two years.

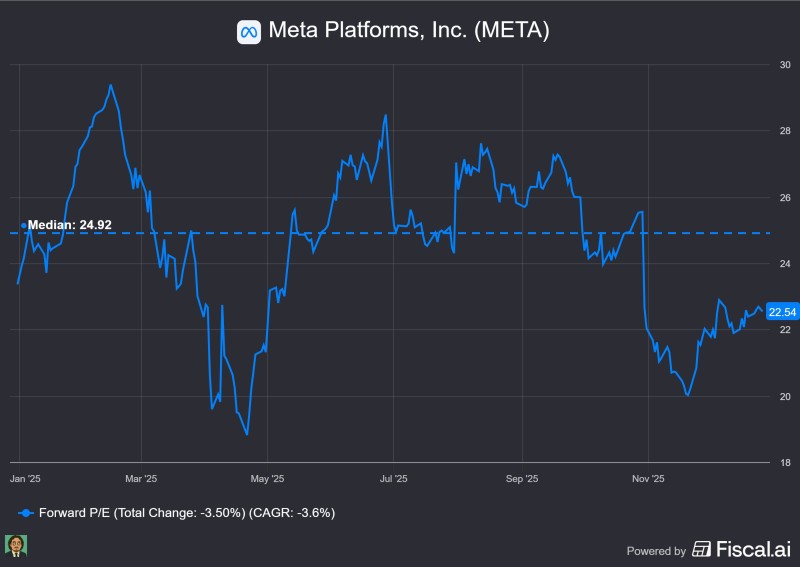

⬤ Here's where it gets interesting: the market might be overdoing it on depreciation worries tied to Meta's current spending spree, while missing the upside completely. Reality Labs could see budget cuts around 30%, saving roughly $5 billion. Meanwhile, AI models like Andromeda and Lattice keep driving efficiency improvements. Revenue growth recently jumped to 26%, way above the 14-15% most people expected. The stock's forward P/E sits at 22.5, below its one-year median of 24.9.

⬤ Looking at 2027, there's a realistic shot at $38 per share in earnings. That scenario puts the stock around $950 with annualized returns hitting 21%. Next year becomes crucial as the market waits to see if Meta can actually deliver on these projections.

⬤ The Meta story captures the tension playing out across big tech right now: short-term cost pressures versus long-term earning power. Companies pouring money into AI and digital platforms while keeping finances tight are walking a tightrope, and how investors view that balance will shape sentiment toward growth stocks going forward.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah