⬤ Meta Platforms is drawing renewed interest after its forward P/E ratio fell to approximately 19.9. The stock is currently trading well below the S&P 500's average valuation, even though the company maintains its reputation as one of the highest-quality global tech firms with strong margins and solid growth potential.

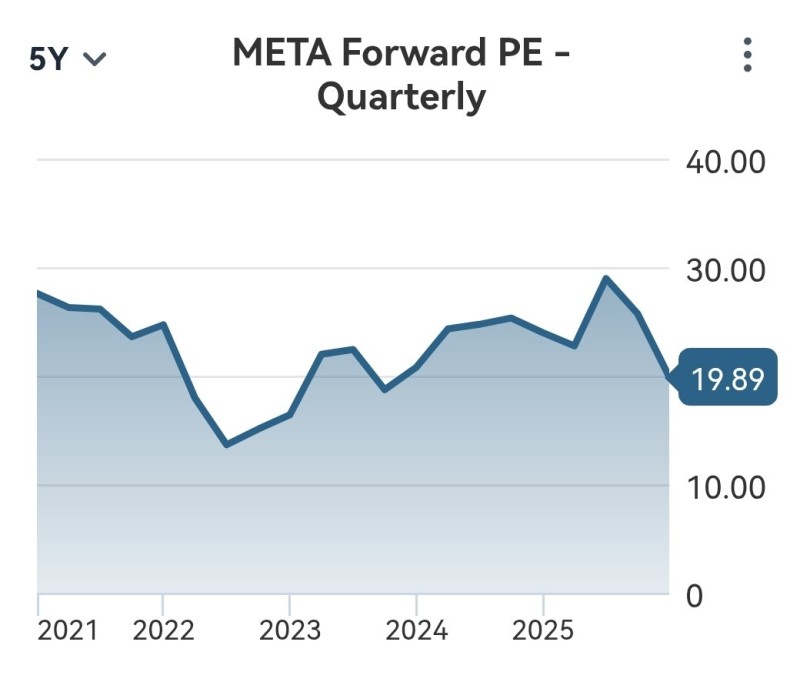

⬤ The META forward P/E chart reveals a clear multi-year cycle. The ratio dropped sharply in 2022 before gradually recovering into 2023 and early 2025. After briefly hitting levels above 30, the forward P/E has now settled back around 19.9, showing a notable de-rating despite steady operational performance. Meta's track record remains consistent, with CEO Mark Zuckerberg staying focused on strategic long-term development rather than reacting to short-term market swings.

⬤ Market commentary also highlights Meta's strong financial position, backed by robust margins and a diversified revenue base. The view that Meta is "a gift" at current valuation levels reflects the belief that the company's fundamentals remain rock-solid, with future growth expected across advertising, platform expansion, AI-driven products, and infrastructure investments. The chart confirms that the stock's valuation has compressed even as its performance metrics stay strong.

⬤ This valuation shift matters because it affects broader sentiment toward mega-cap tech companies. A forward P/E near 19.9 puts META at a discount relative to both its historical range and the broader S&P 500, raising questions about whether current pricing actually reflects the company's long-term earnings potential. As markets rethink valuation levels across tech, Meta's mix of lower multiples and strong operational momentum could play a big role in shaping what comes next.

Peter Smith

Peter Smith

Peter Smith

Peter Smith