Meta's stock slipped after the company posted a dramatic earnings miss in Q3 2025—but don't let the headline fool you. The culprit wasn't crumbling ad revenue or a metaverse flop. It was a massive $16 billion non-cash tax charge that tanked reported earnings per share from what could've been $7.25 down to just $1.00. This accounting quirk dragged Meta's trailing twelve-month EPS from a potential $28.85 to $22.60, spooking investors despite zero impact on actual cash flow or business fundamentals.

The Long-Term Picture Still Looks Strong

Financial analyst Damian Brik notes that without this accounting adjustment, Meta's performance would've looked far stronger, with EPS hitting $7.25 instead of just $1.00.

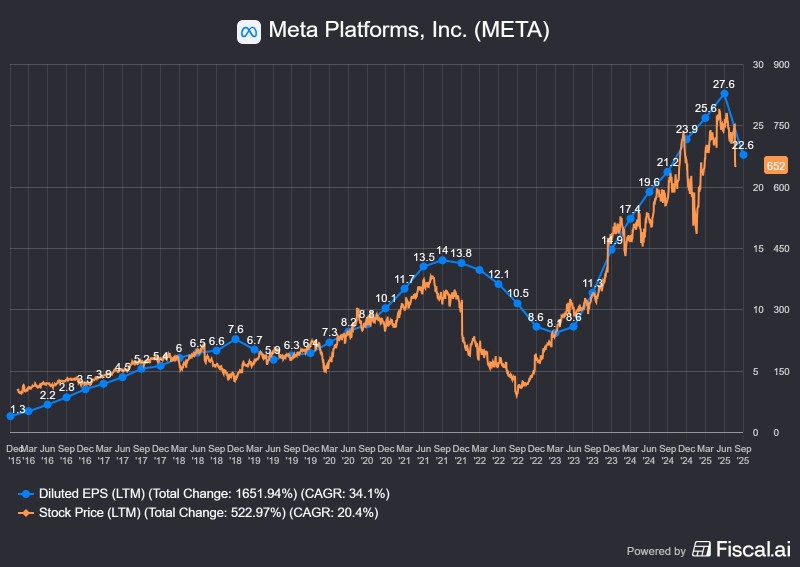

When you zoom out, Meta's growth story remains intact. Since 2015, the company has delivered impressive performance:

- EPS growth: +1,651.9% (34.1% annually)

- Stock price growth: +523.0% (20.4% annually)

- Recent peak: EPS hit $27.6 earlier in 2025 before the tax adjustment knocked it to $22.6

The stock followed suit, pulling back from around $900 to $650. But historically, Meta's EPS and stock price have moved together—and when you strip out the one-time charge, the business is still firing on all cylinders. Ad revenue keeps growing across Reels, WhatsApp, and Threads. AI-powered ad targeting is driving efficiency gains. And profit margins are near multi-year highs when you ignore the accounting noise.

What's Next?

Analysts aren't sweating this blip. Consensus estimates have Meta finishing 2025 with EPS between $26 and $27, then pushing above $30 in 2026. The outlook hinges on continued AI infrastructure investment, monetization wins in messaging and metaverse services, and ongoing efficiency improvements. So while the $16 billion tax hit made for an ugly quarter on paper, Meta's long-term earnings trajectory looks solid—and the market should catch on once the dust settles.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah