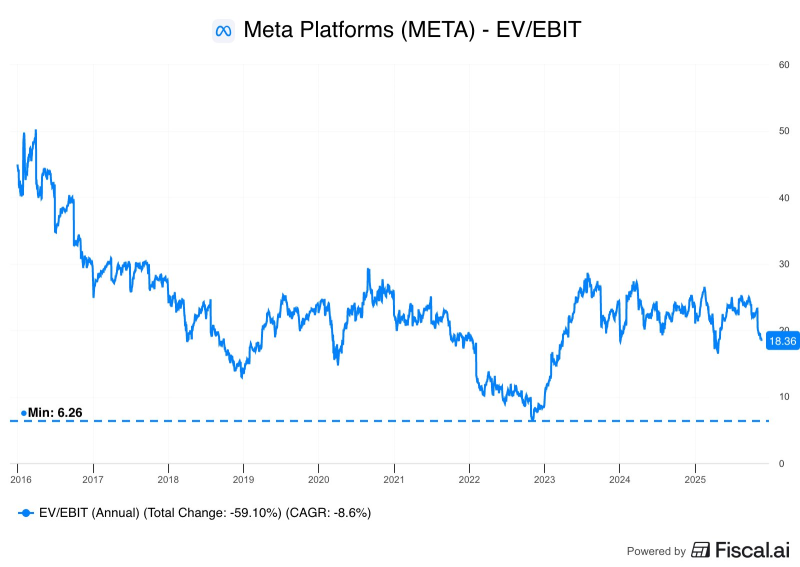

⬤ Meta Platforms (META) has pulled off an impressive valuation comeback after bottoming out in late 2022. Back in November of that year, the company's EV/EBIT ratio dropped to just 6.26×—one of the sharpest drops among big U.S. tech names. Fast forward to today, and that ratio sits near 18.36×, showing investors are willing to pay a lot more for Meta's earnings now than they were two years ago.

⬤ Looking at the bigger picture, Meta's valuation got squeezed hard between 2016 and 2022. The company was burning cash on Reality Labs, dealing with regulatory headaches, and watching its revenue growth slow down. Add in a rough market for growth stocks, and you get that brutal 2022 low. But since then, things have turned around in a big way—the EV/EBIT multiple has jumped more than 190 percent. From 2023 through 2025, the valuation has stayed consistently above 15×, which is a huge shift from where it was during the 2022 selloff.

The sustained rise far above the 2022 lows signals renewed confidence in Meta's long-term earnings trajectory.

⬤ The turnaround isn't just about market sentiment getting better. Meta actually fixed some real problems—they cut costs, their advertising business started performing better again, and they got serious about profitability instead of just chasing growth. The current multiple around 18× isn't as high as it was during Meta's hyper-growth days, but it shows the market has found a more realistic middle ground. The stability in the ratio also shows how Meta's valuation now tracks pretty closely with its actual revenue performance and profit margins.

⬤ This recovery matters beyond just Meta's stock price. The company is huge in major U.S. indexes, so when its valuation moves, it often reflects what investors think about digital advertising, AI spending, and tech investments in general. The fact that META has stayed this far above its 2022 lows suggests people are feeling a lot better about its long-term prospects—and about big tech stocks overall.

Peter Smith

Peter Smith

Peter Smith

Peter Smith