Something interesting is happening with Meta Platforms (META) stock right now. After dropping into a well-defined support zone that Elliott Wave analysts had been watching, the stock is showing signs of life again. The technical setup suggests that traders who bought near the bottom of this correction might already be sitting pretty, with the stock rebounding from what many consider a textbook reversal area.

META Bounces From the $588-$653 Support Zone

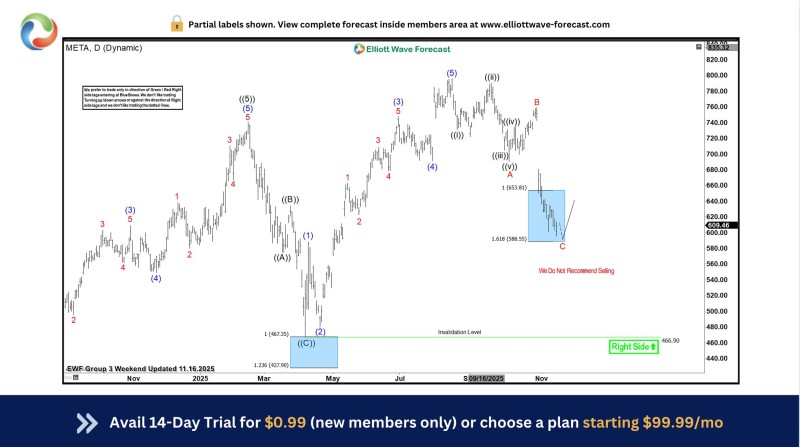

The chart tells a pretty clear story. META completed a classic A-B-C corrective pattern that brought it down into a shaded support zone between roughly $653 and $588. This area, often called the "Blue Box" in Elliott Wave circles, is calculated using Fibonacci extensions at the 1.0 and 1.618 levels.

What's notable here is how cleanly the price action played out. Wave C landed right inside this support zone, signaling that the correction was probably done. The immediate bounce that followed suggests buyers were waiting for exactly this moment. As long as the stock stays above the invalidation level around $467, the bullish outlook remains intact, and the technical picture looks pretty healthy.

This kind of orderly rebound from a predefined zone tends to give traders more confidence that the larger uptrend is still alive and well.

Why META Looks Ready for More Upside

Beyond the technical patterns, there are some solid fundamental reasons to be optimistic about META's prospects right now.

The company's push into AI infrastructure continues to strengthen its competitive position for the long haul. Throughout 2025, Meta has consistently beaten revenue and user engagement expectations, showing that the business fundamentals remain strong. Among mega-cap tech stocks, META has been one of the standout performers, attracting steady institutional buying.

There's also a broader pattern worth noting: investors have been treating pullbacks in big tech names like META as buying opportunities rather than warning signs. When you combine this dip-buying behavior with solid fundamentals and clean technical structure, it creates a pretty compelling case that this bounce could be more than just a temporary reaction.

What's Next for META's Price?

If this momentum holds up, here's what we might see:

META could reclaim its previous swing highs and confirm that the uptrend is back on track. A move back toward the $700+ zone looks like a reasonable target based on the current structure. The stock may start building a new five-wave pattern that pushes prices even higher over time. The critical thing to watch is whether price stays above that $467 invalidation level, which would keep the bullish case intact.

Right now, the market's reaction suggests the correction has run its course and we might be entering the early stages of the next leg higher.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah