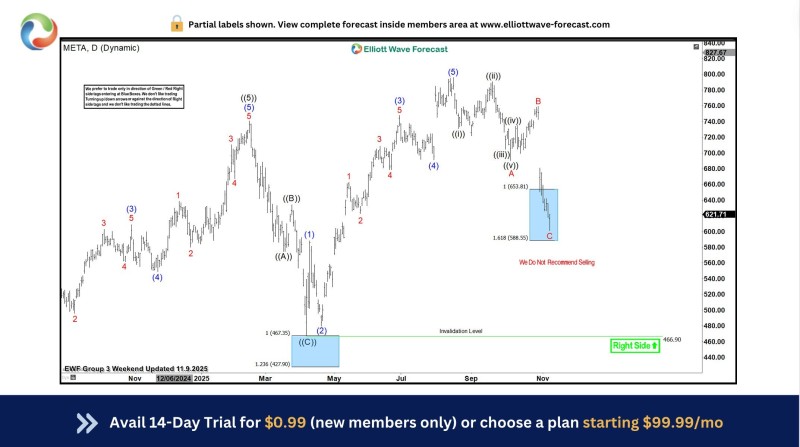

⬤ Meta Platforms (META) has started turning higher after hitting the Blue Box support zone highlighted on the chart. The stock's reaction at this level suggests the anticipated support area is holding, producing an initial bullish response. The chart clearly marks this Blue Box region where the corrective decline appears to have bottomed out.

⬤ When a stock enters a corrective target zone like the Blue Box, traders face immediate risks—like false bounces or continued downside if support breaks. That could mean deeper losses or getting in too early. In this case, long positions taken in the Blue Box area are now considered "risk-free," meaning stops have been adjusted to breakeven or better, protecting traders if momentum fades.

⬤ The stock's behavior suggests the next leg higher may already be underway, signaling the corrective phase could be over. The chart shows the pullback completing within the Blue Box, which aligns with the view that META's broader trend remains bullish. This setup implies META might be ready to resume climbing from here.

⬤ For investors, bounces from well-defined support zones like this can lift sentiment and pull in trend followers. If buying interest keeps building from the Blue Box, META could see a more sustained recovery—potentially boosting confidence across large-cap tech stocks. While no specific price targets are given, the chart structure and bullish tone suggest traders will be watching closely to see if META can deliver follow-through strength.

Peter Smith

Peter Smith

Peter Smith

Peter Smith