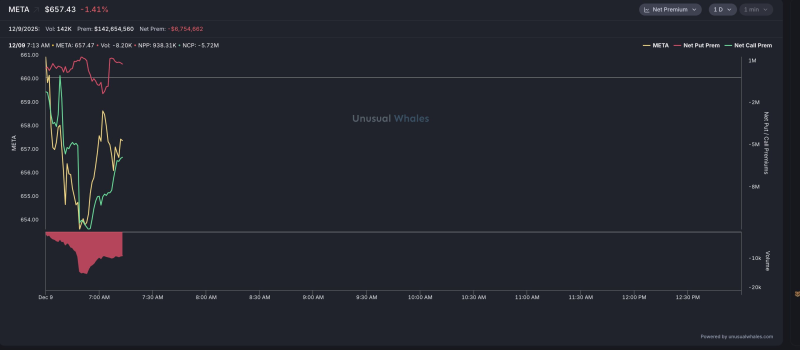

⬤ Meta (META) opened the session weak dropping more than 1 % while options traders added bearish positions. Unusual Whales flow data showed META with heavy negative net premium as the stock fell to about $657 in early trade. The price chart showed steady downward pressure through the morning and traders bought puts.

⬤ META traded between about $654 and $658 in the early hours and tried to steady near 7:30 a.m. Net put premium plunged to almost minus $5.72 million, a sign that traders either hedged heavily or bet on further declines. Call premium stayed quiet and barely moved even when the stock tried small bounces. Volume reached about 142,000 contracts and total options premium stood near $142.6 million.

⬤ The striking feature was the gap between price action and options sentiment. Even as META's share price attempted to flatten, put premium remained high, a hint that traders doubted the slide had ended. Such divergence tends to appear when participants expect more chop ahead or believe sellers still wait. META lingered near the low of its intraday band while puts ruled the flow, a cautious scene.

⬤ The development carries weight because META belongs to the tech giants. When its options flow turns this negative, the effect can spread through the sector. If put heavy activity continues in the coming sessions, it may feed broader wariness among large cap tech names. The way META absorbs this pressure will probably shape short term volatility expectations for the group.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova