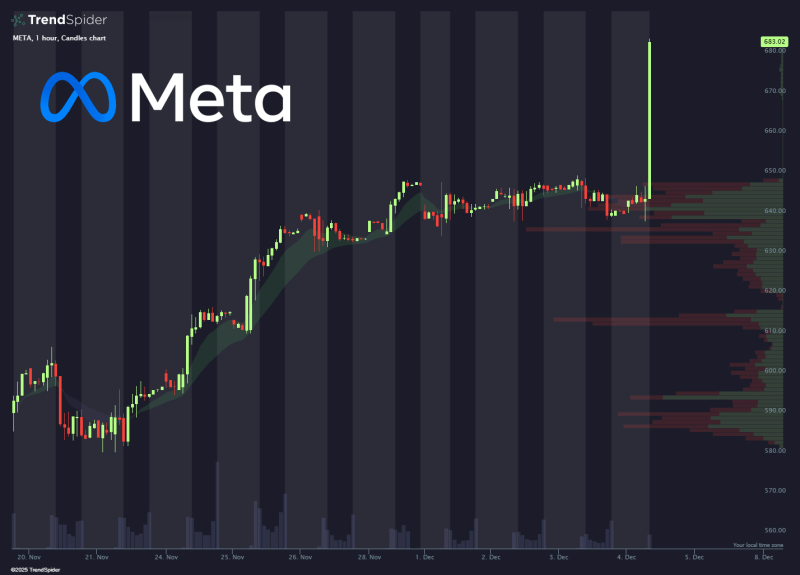

⬤ Meta (META) rose 7 % in pre market trade after it said it will cut metaverse outlays by 30 %. The stock surged on the hourly chart as the news spread - investors welcomed the move to shift capital away from the Reality Labs division.

⬤ The chart shows Meta climbed steadily through late November and early December, held the $640 area then leapt into the upper $600s. Volume jumped on the breakout, a sign that real buying followed the spending shift.

⬤ Strong trade between $620 and $640 built a base for the rally - earlier bids set support levels that held during the sideways stretch. The pre market spike shows how fast the market backed Meta's turn toward leaner operations.

⬤ The change matters because Meta must now balance AI spending with strict cost control. By trimming metaverse outlays, management responds to the efficiency theme that now rules tech talk. The stock's instant lift shows investors favor this practical path over open ended long-term bets.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi