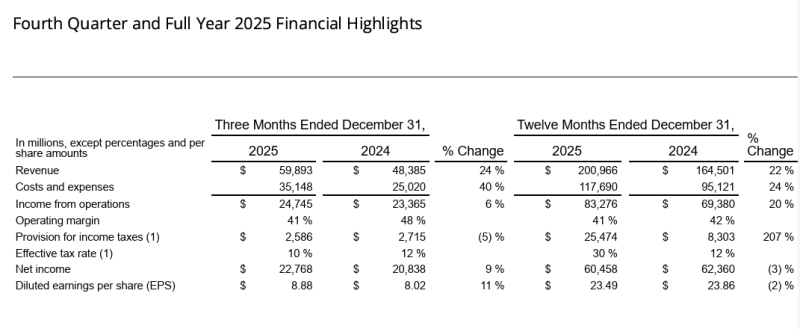

⬤ Meta Platforms blew past Wall Street's Q4 2025 predictions, posting earnings of $8.88 per share versus the expected $8.22. Revenue climbed to $59.9 billion, representing a solid 24% jump from the previous year's quarter. The company's advertising engine continued firing on all cylinders despite mounting operational costs.

⬤ Operating expenses surged 40% year-over-year to $35.1 billion, eating into profit margins. Operating income grew just 6% to $24.7 billion, while margins compressed from 48% to 41%. Net income edged up 9% to $22.8 billion. For the full year, Meta pulled in $201 billion in revenue—a 22% increase—with operating income reaching $83.3 billion.

⬤ User engagement stayed strong with daily active users hitting 3.58 billion, up 7% year-over-year. Ad impressions rose 18% while average ad prices increased 6%. Despite capital spending jumping 48%, free cash flow grew 7%, though Meta didn't buy back any shares during the quarter.

⬤ The real story is what's coming next. Meta's planning total costs between $162-169 billion for 2026—a massive 43% increase driven mostly by infrastructure buildout. Capital expenditures could hit $115-135 billion, nearly doubling from 2025. The company ended the year with $81.6 billion in cash against $58.8 billion in long-term debt, positioning itself for an aggressive AI and infrastructure push that will define its competitive position going forward.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah