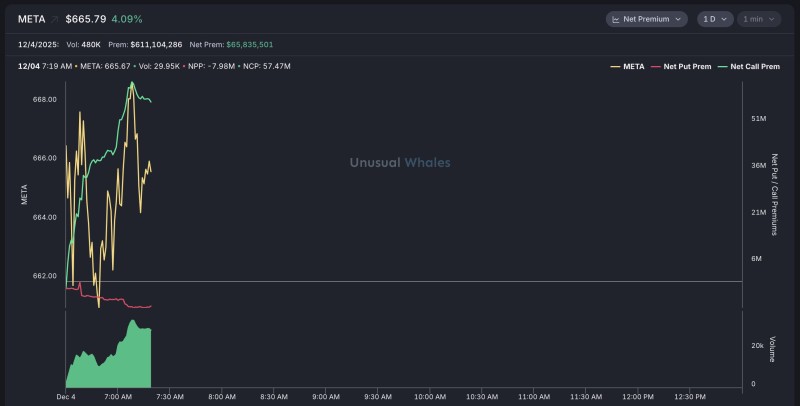

⬤ Meta Platforms saw a strong rally today, climbing 4% as options data revealed a wave of bullish positioning. The stock moved from around $662 at the open to nearly $668 before settling near $666. Net call premium shot up during the early morning hours, showing that traders were betting heavily on upside momentum.

⬤ The options activity was intense—over $611 million in total premium volume with roughly 480,000 shares changing hands. Between 7:05 and 7:30 a.m., net call premium surged past $57 million while put premium trended lower, suggesting traders weren't worried about downside risk. The stock's price movement tracked the call premium spike almost perfectly during this window.

⬤ What makes this move interesting is how concentrated the bullish flow was in that early window. The heavy call-side activity essentially drove the momentum, pushing META higher as more traders piled into bullish positions. While the stock dipped slightly from its intraday peak, it stayed well above opening levels throughout the session.

⬤ This kind of options-driven price action shows how quickly sentiment can shift when big money moves in one direction. META's rally wasn't just about the stock itself—it was about traders positioning aggressively for further upside through options. When call premiums surge like this during high-volume sessions, it often creates a self-reinforcing cycle that keeps momentum going.

Peter Smith

Peter Smith

Peter Smith

Peter Smith