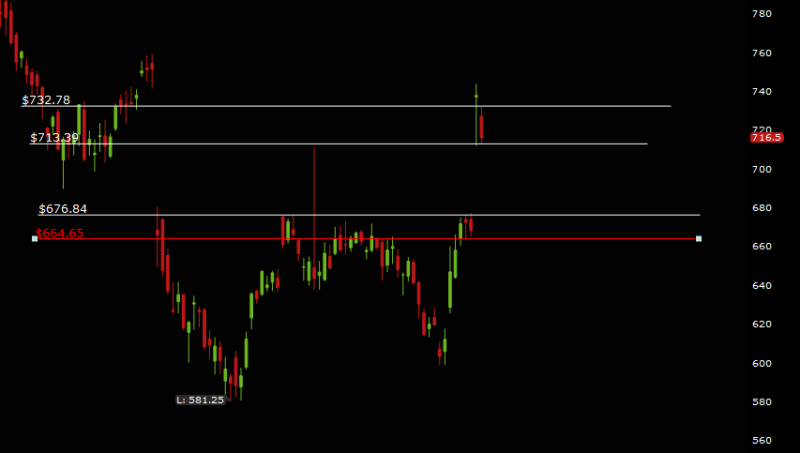

⬤ META is right at a textbook setup. There's a clean unfilled gap sitting between $676 and $713 — the kind of zone that tends to pull price back eventually. Right now, the stock is hovering just above $713, which makes this level the one to watch. If buyers can hold it, great. If not, the gap becomes the story.

⬤ That gap formed during a sharp rally, meaning very little actual trading happened in the $676–$713 range. That's exactly why it matters — gaps like this act like magnets. The market has a habit of coming back to fill them, especially when support at the upper edge starts getting tested repeatedly.

⬤ Here's the thing — if $713 holds, META likely stays above the gap and keeps its current structure intact. But a clean break below that level? That's when things get interesting. A drop into the gap toward $676 becomes very realistic, and that's a $37 move down from current levels. Classic gap-fill behavior.

⬤ META carries serious weight in the major indices, so this isn't just a single-stock trade. How it resolves around $713 will likely ripple into broader sentiment for large-cap tech. Watch this zone closely — the next direction becomes a lot clearer once the gap question gets answered.

Usman Salis

Usman Salis

Usman Salis

Usman Salis