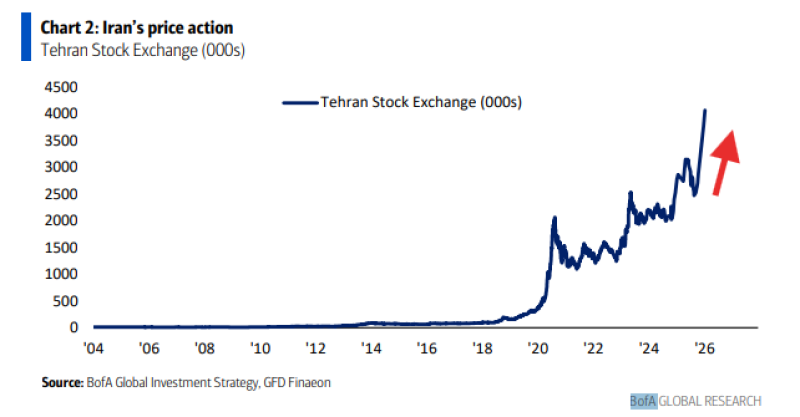

⬤ Iran's stock market has shot up dramatically in recent months, with the Tehran Stock Exchange index hitting fresh highs after a long stretch of steady climbs. The numbers look impressive at first glance—the index has gained roughly 65% since August when measured in local currency. But there's a catch that changes everything about how we should read these gains.

⬤ The problem is simple: those returns are measured in Iranian rials, and the rial has been collapsing. Over the same six-month period, Iran's currency has lost close to half its value against the US dollar. When you adjust for that currency crash, the stock market rally suddenly looks much less exciting. What appears to be strong performance in local terms mostly reflects the currency falling apart rather than companies actually doing better or the economy improving.

⬤ History offers some useful perspective here. Back in 1979, when the Iranian revolution toppled the Shah, global markets went through massive swings in the year that followed. Oil prices jumped about 95%, gold skyrocketed by roughly 244%, and US Treasury yields climbed by around 149 basis points. Those moves show how political upheaval in Iran has triggered major reactions across commodities and financial markets—even when local market signals didn't seem particularly worried beforehand.

⬤ The bigger takeaway is about how we interpret stock market performance in countries dealing with high inflation. When prices rise sharply in local currency terms, it often means investors are scrambling to protect their money from inflation rather than betting on genuine economic strength. Iran's situation is a textbook example of how currency context matters enormously. It also reminds us that geopolitical risks can hide beneath the surface in market pricing, only showing up later when expectations shift and ripple through oil markets, gold prices, and global interest rates all at once.

Usman Salis

Usman Salis

Usman Salis

Usman Salis