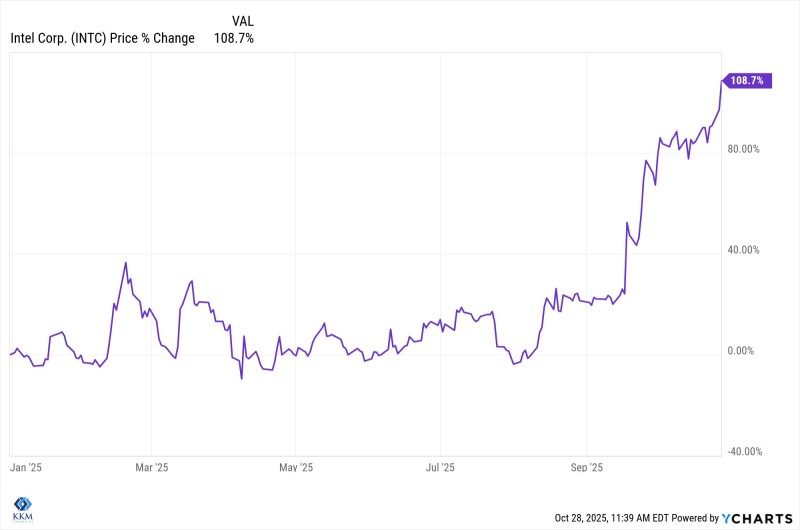

Intel (NASDAQ: INTC) has shocked the market this year, with shares jumping 108% in what's become one of the most dramatic comebacks in tech.

The Numbers Tell the Story

Trader Jeff Kilburg recently noted that even his "greedy" call spread paid off, as Intel tacked on another 10% in just days. It's clear investors are betting big on the chipmaker's revival in the AI age.

The year-to-date chart is striking—Intel traded sideways for months, then exploded higher starting in late August. That breakout turned into a near-vertical climb that's still going strong. For a legacy semiconductor company, this kind of momentum is rare and signals something fundamental has shifted.

Why Intel's Back in the Game

A few things are powering this rally:

AI ambitions: Intel's finally making serious moves in AI chips and foundry deals, putting it back in the conversation with Nvidia and AMD.

Better results: Recent earnings beat expectations, showing improved margins and solid data center growth.

Policy tailwinds: The CHIPS Act keeps funneling support toward Intel's U.S. manufacturing expansion.

Value play: While AI darlings traded at nosebleed valuations, Intel looked cheap—and investors noticed.

Together, these turned Intel from an afterthought into a legitimate growth story again.

The chart's hard to ignore. After months stuck in a range, Intel broke out cleanly and hasn't looked back. The trend is textbook bullish—higher highs, higher lows, and strong buying pressure throughout. Any pullback at this point would likely just be a breather before the next leg up.

Intel's 2025 surge isn't just about numbers—it's proof the company's transformation is real. Doubling in value while maintaining momentum takes both execution and conviction from the market. Whatever skepticism existed earlier this year has clearly given way to belief that Intel can compete in the AI era.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah