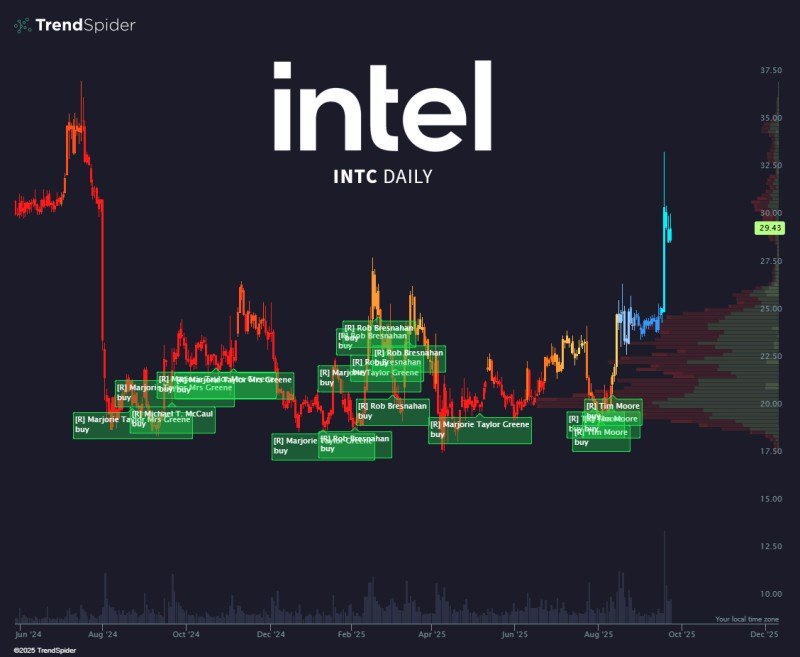

Intel (INTC) stock has finally escaped its year-long trading range, shooting past $29 in one of its strongest moves in recent memory. What makes this breakout particularly fascinating is the pattern of Congressional purchases disclosed over the past year – timing that now looks suspiciously prescient as semiconductors catch fire again.

Intel's Technical Breakout

Intel's chart shows months of foundation-building between $18 and $25, with TrendSpider analysis revealing consistent buying near $20 before advancing into the $25–$27 range.

Strong support around $20 provided reliable demand during dips, while the $27–$28 ceiling that capped Intel earlier this year has been decisively broken. Volume patterns show heavy accumulation by institutional investors between $20 and $25. Shares now trade at $29.43, the highest level since early 2023.

Congressional Activity Raises Eyebrows

- Notable Buyers: Marjorie Taylor Greene, Rob Bresnahan, Michael McCaul, and Tim Moore

- Timing: Multiple purchases during Intel's consolidation phase

- Context: Buys occurred before semiconductor sector revival

With Intel now rallying alongside Nvidia and the broader chip space, traders are questioning whether these lawmakers anticipated the sector's resurgence driven by U.S. industrial policy and global chip demand.

What Happens Next

A clean break above $30 could unleash a move toward $32–$35, levels Intel hasn't seen in years. However, if momentum fades, the former resistance around $27 becomes crucial support for maintaining this bullish structure. The semiconductor sector's broader health will likely determine whether Intel can sustain these gains.

The Bigger Picture

Intel's breakout represents more than just technical momentum – it's a convergence of strategic U.S. investment, industrial demand, and market timing. The Congressional buying patterns have added intrigue to an already compelling technical setup. With the stock finally showing strength after months of consolidation, Intel may have more room to run as both Washington policies and Wall Street sentiment continue to evolve.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah