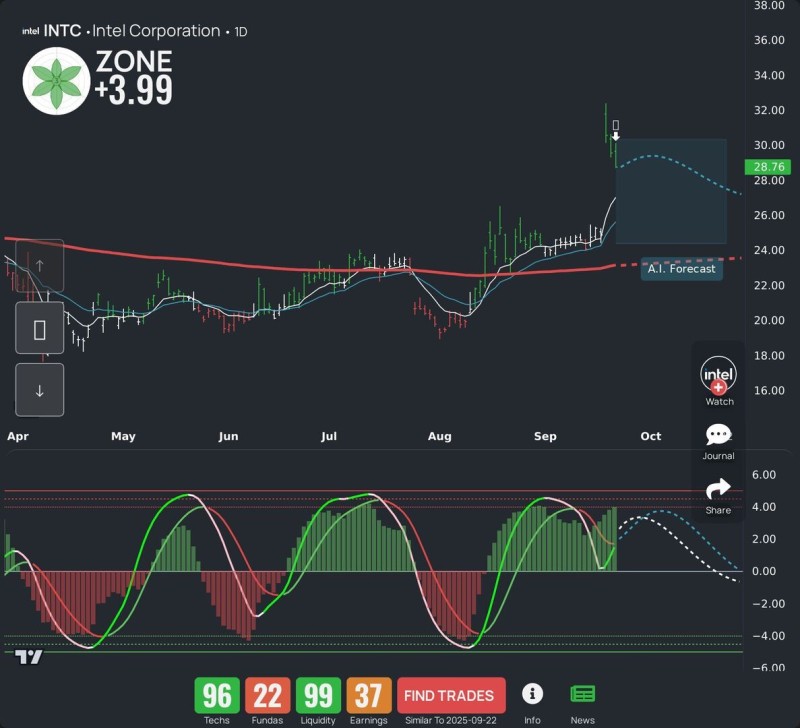

Something's stirring at Intel. After years of watching from the sidelines as Nvidia grabbed all the AI headlines, $INTC is finally showing signs of life. The stock broke past $28 and touched $31 before pulling back, but here's the thing - this isn't just another false start. The technical picture tells a compelling story. Intel has cleared key resistance levels and is sitting on what looks like solid support around $28-29. This is the kind of setup swing traders dream about - clear levels, strong momentum, and AI backing to give it some credibility.

Why Intel Is Finally Moving

Market insights from WealthBranch show AI models are backing this move, suggesting Intel might have found its footing in the new tech landscape.

The rally isn't happening in a vacuum. Three big forces are converging to give Intel its moment. First, there's genuine demand building for AI hardware that goes beyond just graphics cards - Intel's bread and butter server chips are getting a second look. Second, U.S. semiconductor policy is creating a tailwind for domestic players like Intel versus their overseas competitors. Third, and maybe most importantly, traders are rotating out of the obvious AI plays and hunting for value in overlooked names.

This combination of fundamental shifts and technical momentum has created something Intel hasn't had in years - genuine excitement from both institutions and retail traders. The stock's move above key moving averages confirms buyers are stepping in at higher prices, not just bargain hunting.

The Trade Setup

For swing traders, Intel presents a classic risk-reward scenario. Hold above $28 and you're looking at a potential run to $32, maybe even $35 if momentum really kicks in. But lose $26 and this whole rally could unravel fast, taking the stock back toward $24 where longer-term support sits.

The AI models suggest we're in for some choppy action in the near term, with price likely bouncing between $27-29 before making its next big move. That's actually perfect for active traders who can work these ranges while keeping an eye on the bigger picture. The key is patience - let the stock show its hand before committing to either direction.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah