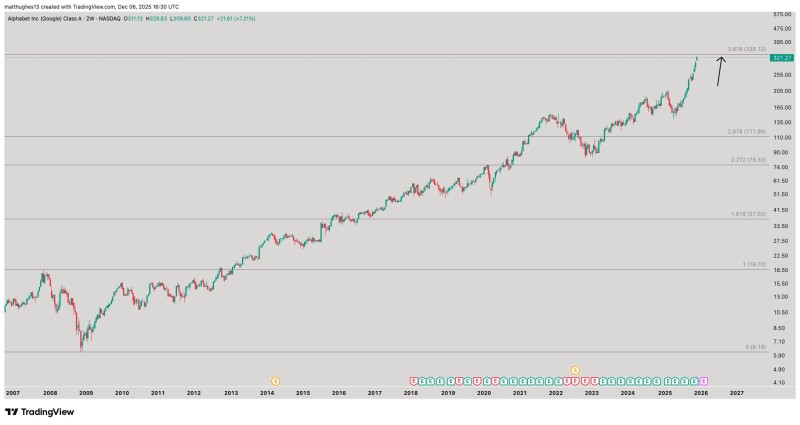

⬤ Alphabet kept pushing higher this week, with GOOGL hitting levels that put it right below a major long-term resistance area. The stock recently traded around $321, getting closer to the notable 3.618 Fibonacci extension level near $338 shown on technical charts. This positioning makes new entries less appealing from a risk-reward standpoint, even though the upward momentum remains strong.

⬤ The long-term chart reveals a multi-year climb through several Fibonacci extension levels tested over more than a decade. Earlier checkpoints like the 1.618 and 2.618 extensions served as consolidation zones before GOOGL continued its ascent. Now, approaching the 3.618 extension represents one of the most stretched positions the stock has reached on this timeframe.

⬤ This matters because long-term resistance zones often shape market behavior when prices reach historically extended levels. A pause here could slow GOOGL's momentum and potentially ripple through the broader tech sector given Alphabet's market weight. However, if the stock powers through this resistance, it would confirm the strength of the long-term trend. The next few weeks will show whether GOOGL consolidates at this level or breaks through to new territory.

Usman Salis

Usman Salis

Usman Salis

Usman Salis