Google's AI infrastructure is operating at massive scale. DeepMind CEO Demis Hassabis recently disclosed that the company processed more than 1.3 quadrillion tokens in a single month, highlighting the enormous computational capacity powering its AI systems. For investors, this raises a critical question: can Google hold its position in the intensifying global AI competition?

Revenue Growth Across Core Segments

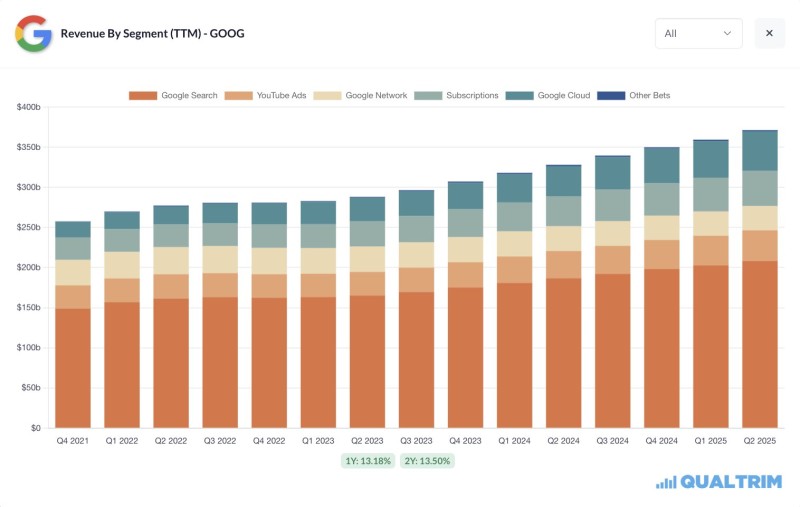

Alphabet's revenue breakdown from Q4 2021 to Q2 2025, as highlighted by Qualtrim trader's analysis, reveals several important trends.

The data shows consistent expansion across multiple business lines:

- Search continues leading the pack with consistent growth as Google refines its advertising platform

- YouTube Ads and Network advertising demonstrate stability with steady contributions

- Subscriptions and Google Cloud are expanding rapidly, capturing a larger portion of total revenue

- Total trailing twelve-month revenue has surged from under $270 billion in late 2021 to approaching $375 billion by Q2 2025

The AI Effect on Google's Business

Hassabis's comments point to three major growth drivers. First, training and deploying AI models at scale creates significant demand for Google Cloud infrastructure. Second, AI improves ad targeting and performance, strengthening Google's core revenue engine. Third, AI-enabled tools in Workspace and subscription products generate predictable recurring income. This combination of advertising dominance and cloud expansion puts Google in a strong position within the AI economy.

Competition and Market Position

Alphabet confronts serious competition from Microsoft and OpenAI in enterprise AI workloads, plus Amazon's AWS leadership in cloud infrastructure. But Google holds distinct advantages by merging a search business with generative AI capabilities, cloud infrastructure built for AI workloads, and cutting-edge research through DeepMind. These assets create a defensive moat that few competitors can replicate.

Usman Salis

Usman Salis

Usman Salis

Usman Salis