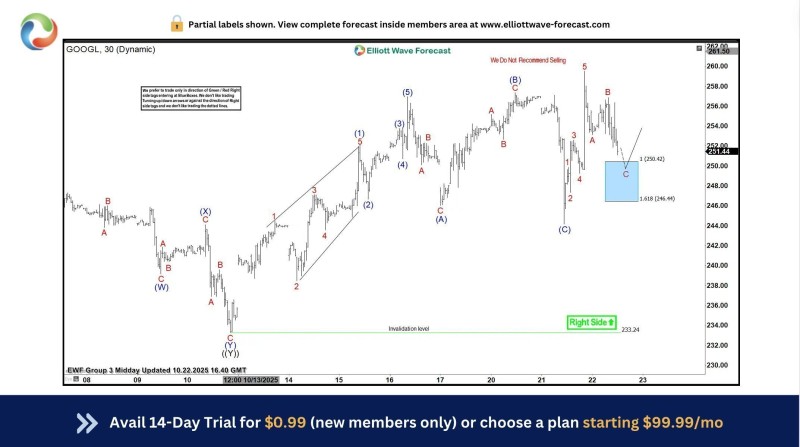

⬤ Alphabet Inc. shares climbed to new highs, with GOOGL reaching the $251 area after bouncing from a well-defined support zone. The price action developed from the Blue Box area where buyers stepped in and reversed the pullback. The chart shows a steady climb toward $250, with bullish pressure building through recent sessions.

⬤ The price structure reveals higher highs and higher lows, signaling continued strength. After consolidating earlier, the stock resumed its advance with brief corrections before pushing higher again. Price remains comfortably above the invalidation level near $233, showing that downside attempts haven't disrupted the broader upward trend.

⬤ The Blue Box area worked as a key reaction zone where demand increased sharply. The rally unfolded in measured steps, with pullbacks staying shallow and getting bought quickly. GOOGL is now trading around $251, suggesting upside momentum stays intact as long as price holds above recent support.

⬤ This move matters for the broader market because Alphabet is a major player in leading equity indices and the tech sector. Continued strength in GOOGL can lift overall market sentiment and boost confidence in large-cap growth stocks. As long as price stays above established support zones, the trend structure looks constructive—though any sustained drop below those levels would signal a shift in short-term dynamics.

Usman Salis

Usman Salis

Usman Salis

Usman Salis