Beyond Meat ($BYND) just delivered one of the harshest blows shareholders could imagine. The plant-based meat company orchestrated a massive debt restructuring that, while potentially saving it from financial collapse, has essentially wiped out existing investor value. The stock nosedived 48% following the announcement, bringing the once-celebrated plant-based pioneer down to levels few could have predicted during its heyday.

The Debt Swap Details

According to Stock Sharks, nearly 97% of bondholders agreed to a deal that converts $1.11 billion worth of 2027 notes into just $208.7 million in 2030 notes—plus a hefty dose of equity. The company issued over 316 million new shares as part of the arrangement, diluting existing shareholders by more than four times their previous stake. While this move takes some immediate pressure off the company's balance sheet, it's come at an extraordinary cost to anyone who owned shares before the announcement.

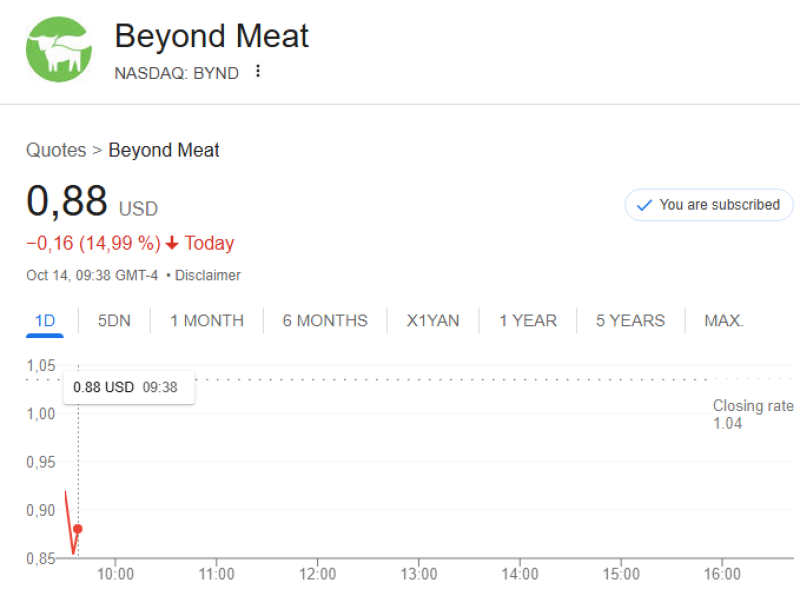

The market's response was swift and unforgiving. Shares collapsed to $0.84, dropping the company's market cap to roughly $80 million. To put that in perspective, Beyond Meat was once valued at $13.4 billion during the peak of the plant-based food craze. That's a fall of over 99%.

What the Chart Shows

The technical picture tells a grim story. Shares smashed through the $1.50 support level and kept falling, hitting fresh all-time lows. Trading volume spiked dramatically, signaling panic selling and mass liquidation. Any attempt at a bounce would likely face resistance around $1.20, but the overall trend looks decidedly bearish. Without some major fundamental shift, the chart suggests the stock could stay under $1 for quite a while.

The Bigger Picture

Beyond Meat's troubles go deeper than just this debt swap. Consumer interest in plant-based meat alternatives has cooled considerably from the early hype. Traditional food companies have jumped into the space with their own products, creating fierce competition. The company had been leaning heavily on debt to keep operations running, and now that debt has essentially been converted into a massive wave of new shares that's drowning existing investors.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah