Berkshire Hathaway's latest regulatory filing reveals another round of significant portfolio cuts, continuing a selling streak that now spans more than three years. The company trimmed stakes in nine stocks during the fourth quarter, including some of Warren Buffett's most iconic holdings.

Berkshire Cuts Apple, Amazon and Bank of America Stakes

The filing shows Berkshire dumped around 7.7 million Amazon shares, slashing the position by about 77%. The company also sold roughly 10 million Apple shares, a 4% quarterly drop, and cut Bank of America by approximately 50.7 million shares, down about 9%.

The company has now been a net seller for 13 straight quarters dating back to the fourth quarter of 2022.

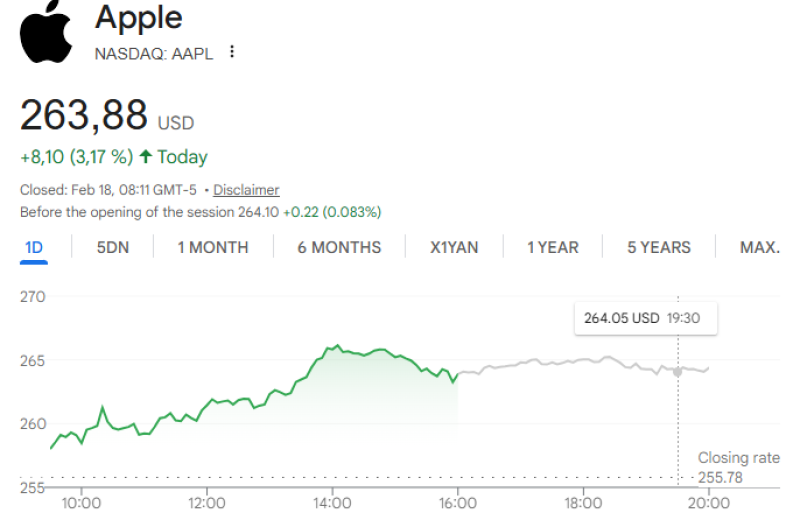

These sales extend a pattern that's been playing out for years. Berkshire has now reduced its Apple stake by roughly 75% since late 2023 and cut Bank of America holdings by about half since mid-2024. The moves signal a fundamental shift in how Buffett's team is managing the portfolio. Related trends appear in AAPL's recent pullback keeping price in the $243-$284 weekly trading range.

$187 Billion Sold Since 2022 in Historic Selling Streak

The bigger picture shows systematic portfolio reduction. During the quarter, Berkshire sold more than $6 billion in equities while buying about $3 billion, creating roughly $3 billion in net sales. The company has been a net seller for 13 consecutive quarters and has offloaded approximately $187 billion in net equities during that stretch.

This sustained exit from major positions affects market sentiment around large-cap leadership. When Buffett sells stocks like Apple, Amazon and Bank of America at this scale, it raises questions about valuations and future returns in America's biggest companies. Similar large-cap dynamics are visible in the combined market capitalization of Apple, Amazon, Microsoft and Google reaching $6.2 trillion.

Market Impact of Buffett's Historic Stock Sales

The multi-quarter reduction in holdings across AAPL, AMZN and BAC may influence how investors view large-cap positioning and capital allocation trends. Berkshire's extended selling activity highlights a deliberate shift away from equity exposure in some of the most widely held benchmark components.

The latest filing covers the final quarter of Warren Buffett's tenure as CEO, making these portfolio moves particularly significant for understanding the company's strategic direction.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah