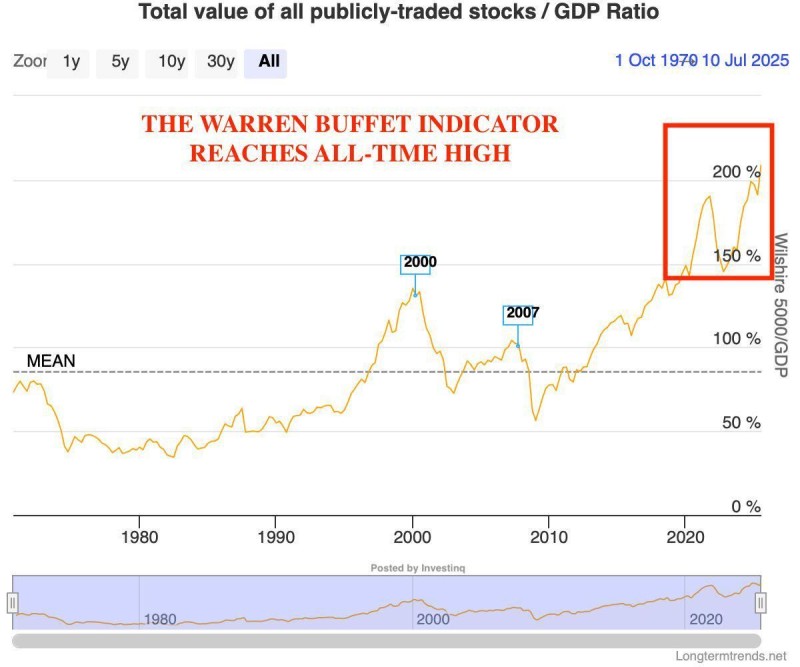

The U.S. stock market is sending one of its strongest warning signals in decades. The Buffett Indicator - Warren Buffett's preferred gauge for determining whether stocks are fairly priced - has jumped to 210%. Put simply, the total value of publicly traded companies is now more than twice the size of the entire American economy. That's unprecedented territory, and it's got people asking some uncomfortable questions about what comes next.

Buffett Indicator at Record Levels

REtipster with Seth Williams recently pointed out that this metric has a pretty reliable history of spotting trouble before it hits. Back in 2000, it topped out around 150% just before the dot-com bubble burst.

In 2007, it flashed red again ahead of the financial meltdown. During the pandemic rally in 2021–2022, it briefly crossed 200%. Now we're at 210%, and that's higher than any previous peak. What this tells us is that stock prices have drifted pretty far from what the actual economy is producing. The gap between perception and reality is widening.

Why Stocks Are So Inflated

There's no single culprit here - it's more like a perfect storm. For years, central banks kept money cheap and plentiful, practically begging investors to take risks. Companies and governments loaded up on debt, which helped pump up asset prices even when real growth wasn't keeping pace. The tech sector, especially AI-driven companies and mega-cap stocks, has ballooned in value and dragged the whole market higher. And let's not forget the retail trading boom - millions of everyday people piling into stocks, often chasing momentum rather than fundamentals. All of this together has created valuations that look pretty stretched when you step back and take an honest look.

Risks for Investors

Markets can stay irrational longer than most of us can stay solvent, as the saying goes. But history suggests these kinds of extremes don't usually unwind gently. If investor sentiment shifts, we could see sharp sell-offs that catch a lot of people off guard. An economic slowdown would expose just how disconnected prices are from underlying business performance. And if policymakers decide to tighten the screws - raising rates or pulling back support - the cushion disappears fast. The folks who usually get hurt the worst are everyday investors who bought in late, chasing returns without fully understanding the risks.

Usman Salis

Usman Salis

Usman Salis

Usman Salis