⬤ NVDA stock has dropped below levels seen before NVIDIA announced over $500B in projected Blackwell and Rubin revenue through 2026. This odd disconnect between price action and fundamentals. The CEO pointed to "stronger month-to-month" demand and has already asked TSMC for more wafer supply, signaling continued momentum.

⬤ The weak market response comes amid new tax proposals targeting high-growth tech companies. These policies create headwinds like reduced capital efficiency, potential brain drain, and financial strain on smaller AI players. Sector-wide uncertainty may be weighing on NVDA despite solid fundamentals.

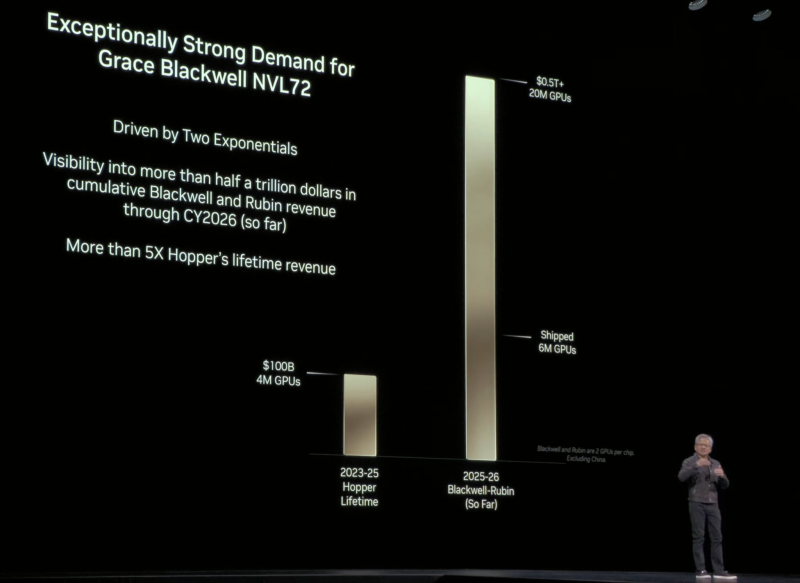

⬤ The muted stock reaction "seems to have stemmed from how Sam Altman responded to Brad's question," meaning near-term sentiment got swayed more by public comments than NVIDIA's actual revenue outlook. The slide deck shows the massive scale of Blackwell and Rubin—over 20 million GPUs and 5× Hopper's lifetime revenue—highlighting demand surging into 2025–2026.

⬤ With NVDA now trading below pre-announcement prices, investors are looking for a reset. Strong demand acceleration, higher wafer allocations, and multi-year revenue visibility back the long-term case. But short-term sentiment faces pressure from policy risks, macro concerns, and influential AI sector commentary.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi