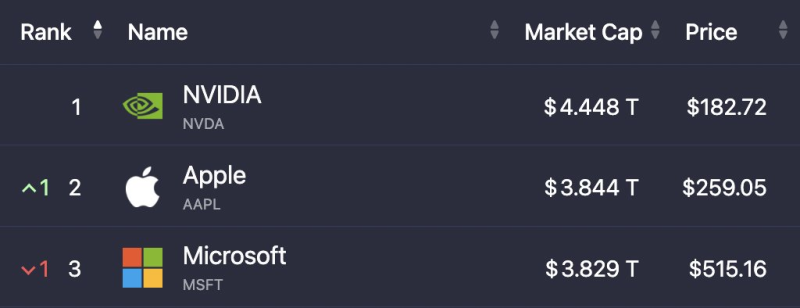

● According to Stock Sharks, Apple has jumped back into second place globally, pushing Microsoft down to third while Nvidia holds the top spot. The numbers tell the story: Apple sits at $3.844 trillion, Microsoft at $3.829 trillion, and Nvidia way out front at $4.448 trillion.

● The proposal & risks behind this shift come down to where investors are placing their bets—AI infrastructure versus consumer tech. Nvidia's lead shows the market's obsession with AI chips and computing power. Apple's comeback suggests people are feeling good about its devices and services again. Still, there's concern that if the economy softens or iPhone sales don't pick up steam despite all the AI features Apple's adding, growth could stall.

● From a financial impact & alternative perspective, Apple's bounce back proves it can keep printing cash even when times get tough. Its services business—App Store, iCloud, Apple TV+—pulls in high margins and smooths out the bumps from hardware sales. Microsoft slipping to third doesn't mean much long-term; it's still crushing it in cloud and enterprise AI.

● The broader context & consequences here point to a major shift in tech leadership. Nvidia's trillion-dollar cushion shows investors are piling into companies that build the picks and shovels of AI—chips, infrastructure, computing. Apple and Microsoft are playing a different game, weaving AI into software and devices. This reshuffling will likely define the sector's pecking order well into 2026.

Usman Salis

Usman Salis

Usman Salis

Usman Salis