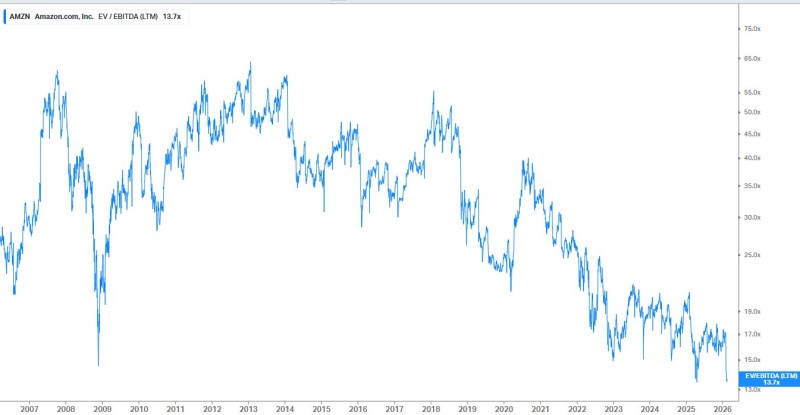

⬤ Amazon is trading at one of its cheapest valuations in nearly 20 years. Right now, AMZN sits at an EV/EBITDA multiple of around 13.7x - dangerously close to the rock-bottom levels we saw during the 2008 financial crisis. The company that literally builds the infrastructure behind today's tech revolution is priced well below where it's traded for most of its history.

⬤ The historical chart shows Amazon's valuation has expanded and contracted through different economic cycles, but what we're seeing now is near the absolute floor. Despite Amazon's massive role in cloud computing and digital infrastructure, the market is giving it a compressed multiple. It's worth noting that a similar valuation story played out recently, as covered in AMZN stock at its cheapest in over a decade.

⬤ The source points out something even more striking: the EV/EBIT metric has only been lower once - during 2008. That means current pricing sits in a historically rare zone, the kind we typically see during major macro uncertainty, not during growth phases.

The market's nervous reaction to Amazon's big spending was also highlighted in AMZN stock drops 18% as $470B evaporates over AI spending fears.

⬤ Here's what matters: when a major infrastructure player trades near historical valuation lows right in the middle of a massive tech transition, it tells you the market is pricing in serious caution. Whether that caution is justified or presents an opportunity depends on your view of Amazon's structural importance going forward.

Peter Smith

Peter Smith

Peter Smith

Peter Smith