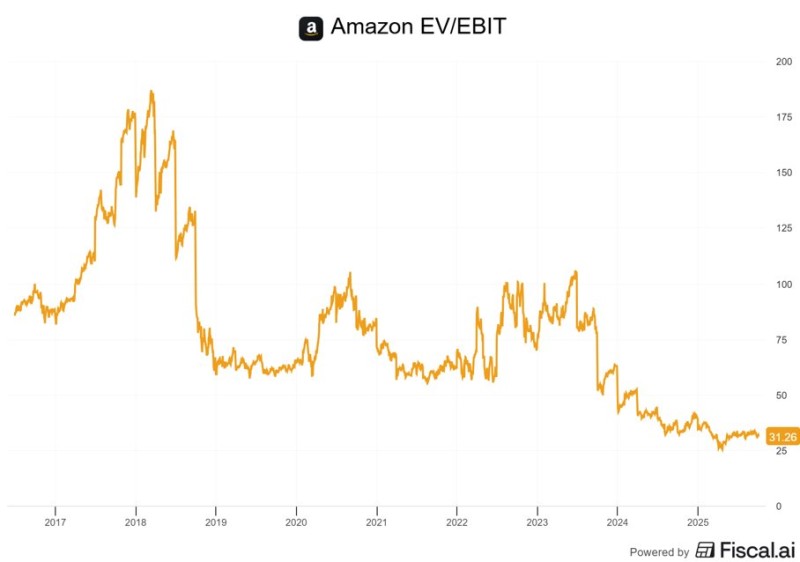

Amazon (AMZN) has always been the poster child for aggressive growth, usually trading at sky-high valuations that made value investors wince. But something interesting is happening right now. The company's EV/EBIT ratio has collapsed to just 31.26—a level we haven't seen since 2014.

Chart Analysis: From Peak to Decade Lows

According to data shared by Shay Boloor, this represents the cheapest Amazon has been in over a decade. For investors who've been sitting on the sidelines, this could be worth paying attention to.

Looking at the chart tells a pretty clear story about Amazon's valuation journey:

- The 2017–2018 euphoria: Amazon's EV/EBIT rocketed above 175x as investors bought into the vision of endless expansion and market dominance.

- The 2019–2021 comedown: Reality set in, and the valuation pulled back sharply, settling into a more "reasonable" 50–100x range.

- The 2022–2023 squeeze: Rising interest rates, bloated operating costs, and cooling e-commerce demand started weighing heavily on the stock.

- The 2024–2025 bottom: Now we're sitting at 31x—the lowest multiple in over ten years, signaling what could be a genuine market repricing.

Why Has AMZN's Valuation Dropped?

There are a few big reasons why Amazon's valuation has taken such a hit. Higher interest rates have made investors far less willing to pay up for growth stocks with lofty multiples. Amazon's profit margins have been under pressure too, squeezed by rising logistics costs, wage inflation, and massive ongoing infrastructure investments. AWS, which used to be the golden goose driving most of the profits, has seen its growth rate slow down. And perhaps most importantly, there's been a broader shift in what investors care about—less obsession with revenue growth at any cost, more focus on actual cash flow and earnings stability.

On the surface, this valuation drop looks like investors are worried about Amazon's future. And they might be right to be cautious. But history has a way of rewarding those who buy quality companies when they're out of favor. Right now, Amazon seems to have found support around that 30x EV/EBIT level. If the company can get its margins back on track and reignite AWS growth, we could easily see the valuation climb back toward 50x or higher. That's a pretty compelling upside scenario for anyone willing to be patient.

Usman Salis

Usman Salis

Usman Salis

Usman Salis