Amazon (AMZN) long regarded as one of the market's most expensive growth stories, is now trading at its lowest valuation in more than a decade. This dramatic repricing has investors wondering whether the company's best days are behind it or if the market is simply overlooking its enduring strengths in e-commerce and cloud infrastructure.

Amazon's EV/EBIT Ratio Signals Historic Undervaluation

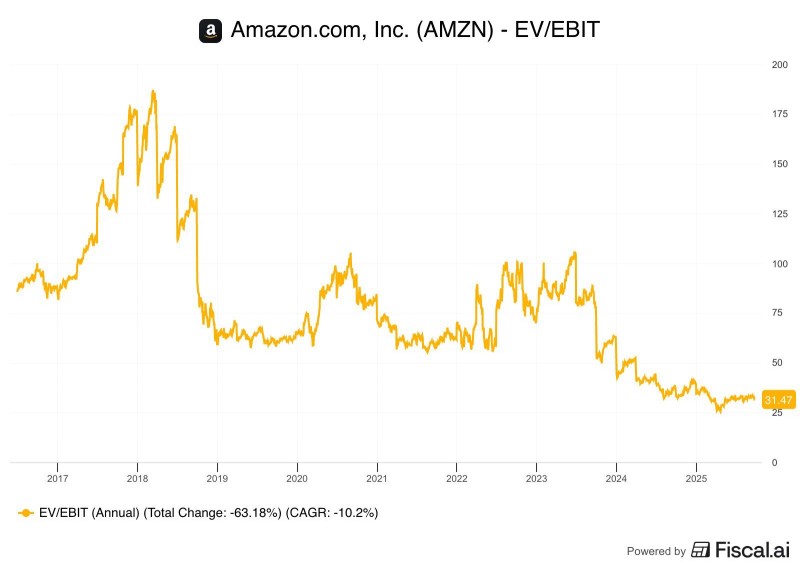

Trader and analyst at Dividend Talks on YouTube recently highlighted just how severe the decline has been. Amazon's EV/EBIT ratio has dropped over 63% from its peak, falling from highs above 175 during 2017–2018 to just 31.47 in 2025.

That translates to a compounded annual decline of -10.2% over the past ten years. It's a level rarely seen for a company that dominates both global online retail and cloud computing through AWS.

What's Behind the Valuation Drop

A few key factors explain why Amazon's multiple has compressed so dramatically. First, margin pressure in its core retail business continues to offset the profitability generated by AWS. Second, rising labor and logistics costs have crimped EBIT growth across the board. Third, the broader market has rotated toward companies with more predictable cash flows, especially in a higher interest rate environment. Together, these forces have led to a sharp repricing of Amazon's stock and forced investors to rethink the growth narrative they once took for granted.

Historical Context: Peaks, Crashes, and Opportunities

The data shows that Amazon's EV/EBIT ratio tends to move in cycles. Sharp peaks in 2018 and 2021 were both followed by steep declines. In the past, those pullbacks often presented strong entry points for long-term buyers. But this time feels different. Competition is intensifying on multiple fronts. Microsoft Azure and Google Cloud are chipping away at AWS's market share, while traditional retailers like Walmart and Target have significantly upgraded their digital operations, making it harder for Amazon to maintain its e-commerce dominance.

What's Next for AMZN

If Amazon can stabilize its operating margins and get EBIT growth back on track, the current valuation could prove to be an attractive buying opportunity. But if cost pressures continue and competition keeps accelerating, the multiple could fall even further. That would challenge the long-standing belief that Amazon deserves a premium valuation simply because of its scale and market position.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah