Consumer confidence in the United States sits near rock bottom, and Amazon's (AMZN) e-commerce business is feeling the squeeze. Shoppers are holding back, sticking mostly to essentials. But for investors with patience, this downturn might actually be setting up an unusually attractive entry point.

Consumer Sentiment and Amazon's Position

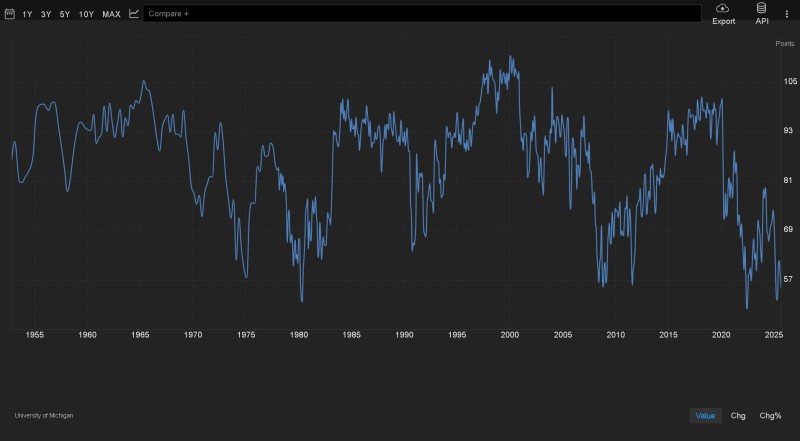

Market analyst Bourbon Capital recently highlighted the University of Michigan consumer sentiment index, showing confidence levels that rival some of the darkest economic moments in modern history - the 1970s stagflation, the 2008 financial crisis, and the 2020 pandemic collapse.

Meanwhile, Amazon's retail segment has essentially flatlined over the past five years. With consumers cutting back on anything that's not absolutely necessary, the company's once-dominant e-commerce engine has lost its momentum. Investors are getting impatient, and some are openly questioning whether leadership has lost its edge.

What History Shows

The sentiment chart tells a familiar story: deep troughs followed by sharp recoveries. Every major downturn in consumer confidence has eventually reversed, often bringing strong equity market rallies along with it. Today's pessimism, while painful in the moment, looks a lot like the conditions that historically preceded long-term buying opportunities.

Why Investors Keep Accumulating

Amazon's retail slowdown is real, but it's not the whole picture. Amazon Web Services (AWS) keeps growing and remains the company's profit engine, while advertising revenue is climbing steadily, both segments help offset weaker retail numbers and keep Amazon positioned for a rebound when spending eventually picks back up, depressed sentiment and a cheaper stock price can create exactly the kind of setup long-term investors look for before the next cycle begins.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah