Amazon (AMZN) shares plunged over 96% between 1999 and 2001, making it one of the most dramatic casualties of the dot-com bust. What looked like a total disaster at the time, however, became the starting point for one of history's greatest corporate comebacks.

The Boom and the Crash

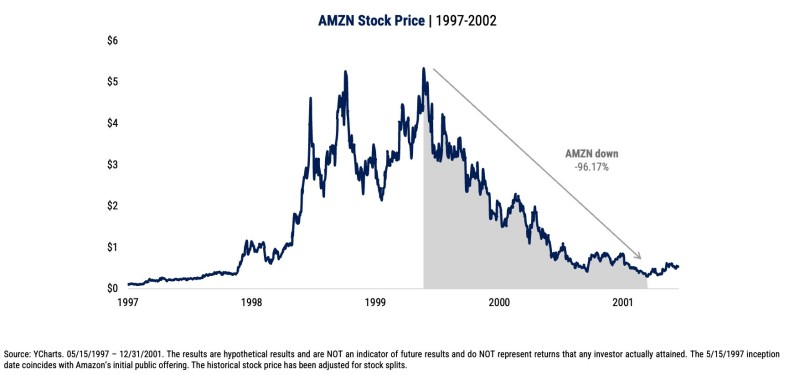

The late 1990s were electric with internet optimism. Amazon, which went public in 1997, rode this wave hard - its stock hit nearly $6 by late 1999. Then everything fell apart. As trader Tiho Brkan pointed out, Amazon's stock collapsed by 96.17%, erasing years of gains and dropping below $1 by 2001.

Investors who bought at the peak watched their portfolios get shredded.

What the Chart Shows

Looking at the price action, you can see three distinct phases. From 1997 to 1999, Amazon climbed steadily before rocketing into a speculative blow-off top. The 2000–2001 period brought relentless selling, with every bounce getting crushed as the bear market ground on. By 2001, the stock finally found a floor near historical lows, forming a base that would later support years of growth. It's a textbook bubble cycle: hype, mania, collapse, reset.

What Investors Should Take Away

The Amazon story shows how quickly hype-driven valuations can evaporate. But it also proves that companies with real business models can survive - and eventually dominate - after brutal declines. The key is separating short-term noise from long-term fundamentals. Deep drawdowns don't always mean the end; sometimes they're just the clearing out of excess before the real growth begins. Patience and a focus on what actually matters can make all the difference in spotting future winners buried in the wreckage.

Looking Back

Today, Amazon is worth over a trillion dollars. But its 1997–2002 chart is still worth studying. It's a reminder that bubbles punish reckless speculation, but they don't kill real innovation. The companies that survive these purges often come back stronger, proving that genuine value can outlast even the ugliest market cycles.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah