Amazon (AMZN) stock is navigating a crucial technical range as it struggles to maintain momentum above key resistance levels. Sellers have repeatedly pushed the price back from the $230 area, and the chart now shows potential downside targets. Traders are watching closely to see if institutional buyers might step in at lower levels to stabilize the decline.

Technical Outlook

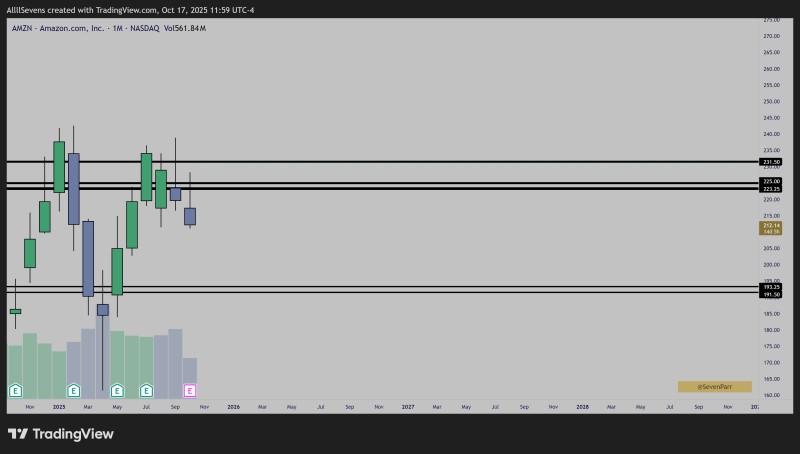

Recent analysis by Seven indicates AMZN is trading within a confirmed inefficiency zone below $230. The monthly chart reveals strong supply pressure between $223 and $231 - an area where upward attempts have been consistently rejected.

The current price hovers near $212, sitting below this inefficiency block. Key levels to watch include:

- Resistance Zone: $223–$231

- Current Price: Near $212

- Support Range: $191–$193, matching historical accumulation areas

- Bearish Target: Low $190s if selling pressure continues

Unless AMZN can push back above $223, bearish momentum may drive the stock down toward the $190 support zone.

Market Factors and Institutional Positioning

Institutional accumulation refers to periods when large players build positions at discounted prices. These phases often coincide with chart inefficiencies, where supply gets absorbed before long-term buying interest emerges. Amazon's current price action also reflects broader market headwinds, including rising bond yields, Federal Reserve policy uncertainty, and volatility across the tech sector. These factors have made investors more cautious about adding exposure at current levels.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi