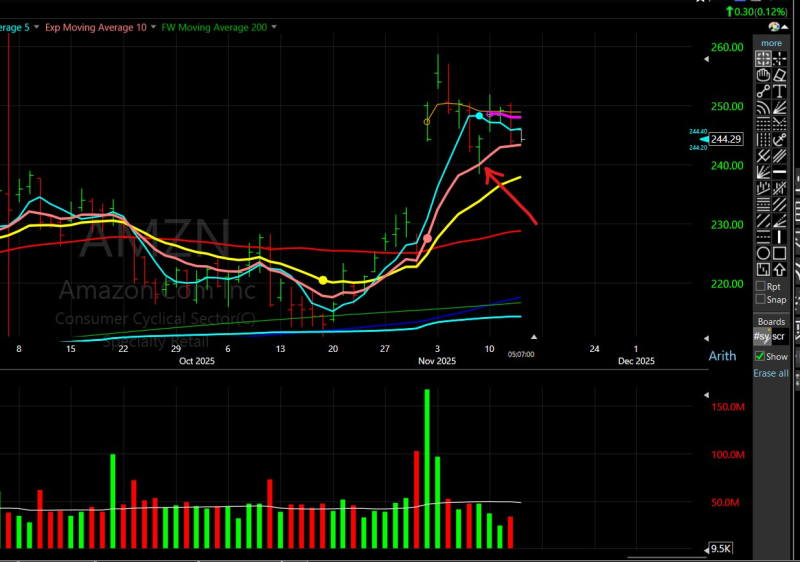

⬤ Amazon (AMZN) disappointed some investors last week after a quick selloff, but the stock stabilized when it hit its 10-day moving average on both Friday and Monday. The chart shows a clear pattern: shares surged in early November, then pulled back to rising short-term support where buyers stepped in. This price action has made Amazon a focal point for traders trying to figure out if a new rally is forming.

⬤ Beyond the day-to-day chart movements, Amazon faces bigger questions around potential tax changes that could hit tech and e-commerce companies. Proposed corporate tax hikes, changes to capital gains rules, and new limits on R&D deductions might increase costs across the sector. Smaller online retailers and logistics-heavy businesses could struggle if higher taxes squeeze their ability to reinvest. And if stock-based compensation gets taxed more heavily, tech companies might find it harder to keep specialized talent in AI, cloud computing, and fulfillment engineering. These longer-term concerns add complexity even as the stock tests an important technical level.

⬤ The bounce off the 10-day moving average puts Amazon at a crossroads. If support holds, bulls might view the pullback as a healthy pause in an uptrend. But if tax policy risks grow or consumer spending weakens, the stock could lose its footing. Right now, Amazon remains in focus as investors weigh technical signals against broader policy and economic uncertainties.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah