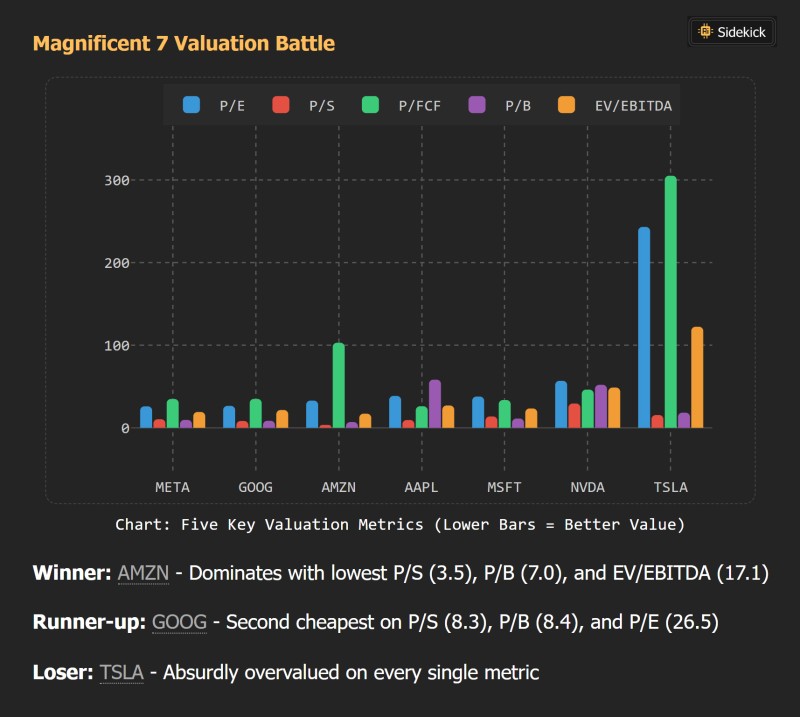

As markets reassess stretched valuations amid rising rates and shifting sentiment, investor focus has turned to fundamental metrics within mega-cap technology stocks. A recent comparative analysis of the Magnificent Seven reveals Amazon emerging as the clear value leader, significantly outperforming META, GOOG, AAPL, MSFT, NVDA, and TSLA across five core valuation measures.

Amazon Dominates the Valuation Comparison

The data shows Amazon as the standout value play among tech giants, with the analysis comparing P/E, P/S, P/FCF, P/B, and EV/EBITDA metrics across the group.

Amazon posts impressive numbers across the board:

- Lowest P/S ratio at 3.5

- Lowest P/B ratio at 7.0

- Strong EV/EBITDA reading of 17.1

Despite aggressive expansion in cloud infrastructure, AI services, and logistics automation, Amazon trades at surprisingly modest levels relative to its earnings and cash-flow generation potential.

Alphabet Claims Second Position

Alphabet comes in as runner-up with consistently attractive metrics: P/S of 8.3, P/B of 8.4, and P/E of 26.5. The company's stable margins, diversified revenue streams, and growing AI infrastructure demand position it as one of the more reasonably priced mega-cap names.

Tesla Shows Extreme Premium Pricing

Tesla sits at the opposite end, with every valuation metric—P/E, P/S, P/FCF, P/B, and EV/EBITDA—far exceeding its peers. The data makes the situation clear: Tesla carries the highest premium in the group by a wide margin, raising questions about sustainability at current levels.

Investment Implications

The valuation spread within the Magnificent Seven highlights key market dynamics. AI-driven revenue expectations continue boosting multiples for cloud and chip leaders, while cash-flow stability enhances confidence in companies like Amazon and Alphabet. Meanwhile, premium-priced stocks face growing pressure as markets reassess risk and hunt for value.

Amazon's combination of scale, profitability momentum, and attractive pricing creates one of the most compelling opportunities in high-growth tech right now.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah