AMD experienced strong momentum in early trading as multiple investment firms revised their outlooks upward following the company's recent Analyst Day presentation. The stock jumped to $251.40 in premarket hours, up from Friday's close of $237.62, driven by a wave of positive analyst sentiment.

Analyst Updates Signal Confidence

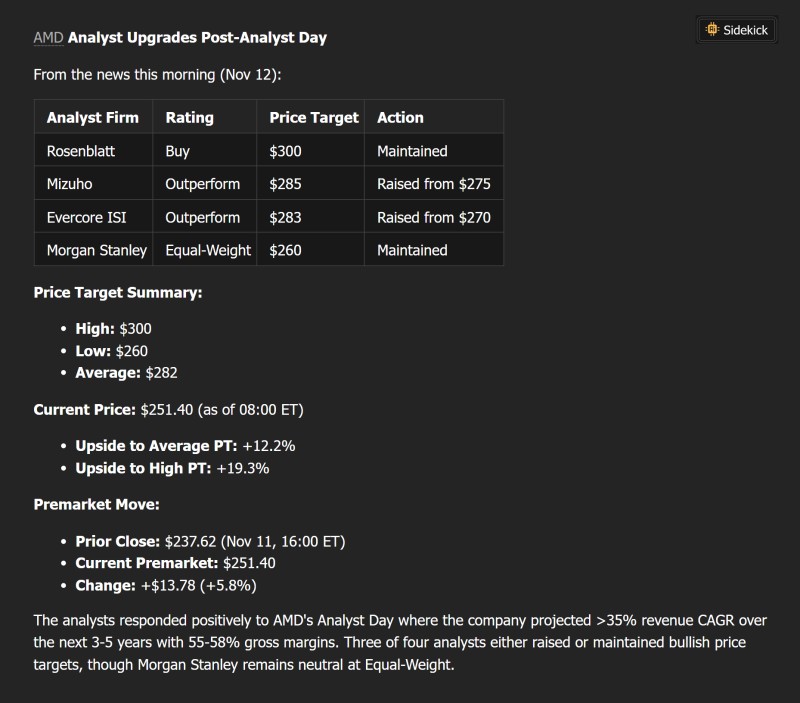

Recent analyst activity shows growing conviction in AMD's trajectory. Rosenblatt maintained its Buy rating with a $300 price target, the most bullish projection in the group.

Mizuho and Evercore ISI both kept their Outperform ratings while lifting targets to $285 and $283, up from $275 and $270 respectively. Morgan Stanley stayed neutral with an Equal-Weight rating and $260 target.

Key Price Targets:

- Rosenblatt: $300 (Buy)

- Mizuho: $285 (Outperform, raised from $275)

- Evercore ISI: $283 (Outperform, raised from $270)

- Morgan Stanley: $260 (Equal-Weight)

The revised targets place AMD's average price objective at $282, suggesting roughly 12% upside from current levels. The highest estimate points to nearly 19% potential growth ahead.

Ambitious Growth Projections Fuel Optimism

The upgrades followed AMD's Analyst Day, where management laid out bold plans including over 35% revenue growth annually for the next three to five years, with gross margins expected between 55% and 58%. These projections underscore the company's confidence in capturing market share within AI and data center segments, particularly through its Instinct MI300 accelerator lineup and expanding presence in high-performance computing.

Analysts highlighted AMD's strategic focus on scalable, energy-efficient processors as a key differentiator that could help close the gap with competitors in enterprise markets. The company's diversified chip portfolio and consistent execution continue to make it an attractive investment in the semiconductor space.

Technical Momentum Builds

The premarket surge pushed AMD through near-term resistance around the $250–$252 range, accompanied by elevated trading volume that confirmed the strength of buyer interest. This breakout positions the stock to potentially test the $270 level, which marked a local high earlier this year. If momentum holds above $250, many analysts see a clear path toward the $280–$300 range over the coming months.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir