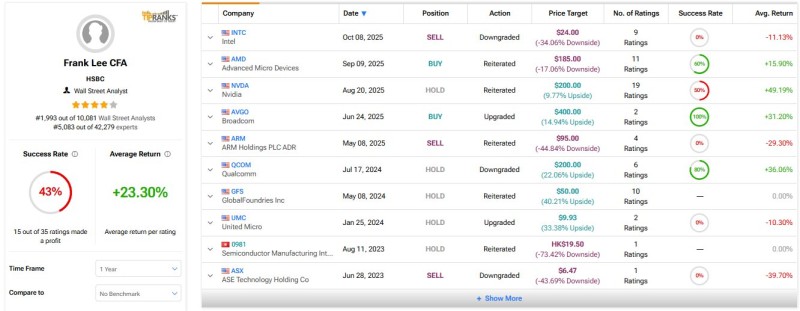

Advanced Micro Devices (NASDAQ: AMD) just got one of its most bullish calls yet. HSBC analyst Frank Lee bumped his price target from $185 straight to $310 while keeping his Buy rating intact. It's a vote of confidence that AMD isn't just chasing NVIDIA anymore—it's becoming a real player in the AI chip race.

What's Behind the Upgrade

According to Mike, the move reflects a shift in sentiment around AMD's growth story. Frank Lee isn't new to AMD. He's got a 60% accuracy rate on the stock with average returns around 16%. His call centers on a few key points: AMD's MI300 GPUs are starting to gain real traction with big cloud providers, the datacenter business is picking up speed, and the company's valuation hasn't caught up to its growth potential yet. Add better chip supply and an aggressive product pipeline, and you've got a stock that HSBC thinks is worth a lot more than most people realize.

The Technical Picture

AMD's been hanging around the $150–$160 zone lately, finding support each time it dips. The real test is $200—that's where resistance sits. If it breaks through cleanly, it could validate the bullish case. Institutional money has been trickling in on recent rallies, which suggests bigger players are quietly building positions.

This isn't just about one analyst raising a number. It's part of a bigger shift in how Wall Street sees the semiconductor space in the age of AI. AMD used to be viewed mainly as the scrappy competitor to NVIDIA and Intel. Now it's being taken seriously as a potential leader in AI computing. The MI300 lineup is winning over customers, AMD keeps stealing CPU share from Intel, and its foundry partnerships are locking in long-term supply.

That's the big question. Getting there would mean solid uptake of the MI300 in AI datacenters, continued momentum in the CPU market, and flawless execution against tough competition. It's ambitious, but not impossible if the pieces fall into place.

Usman Salis

Usman Salis

Usman Salis

Usman Salis