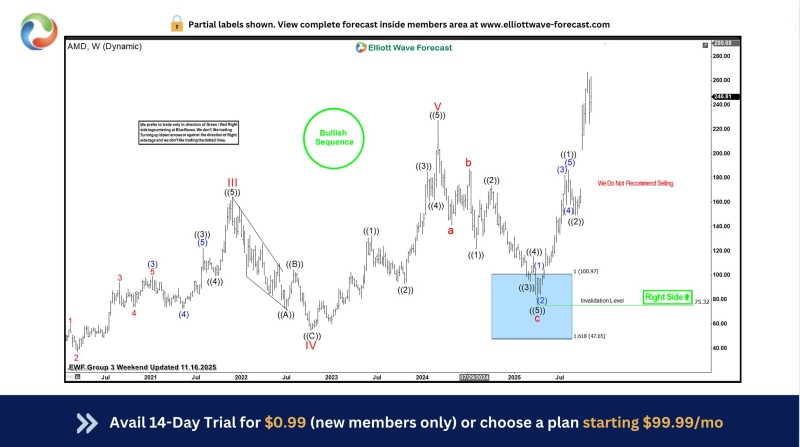

⬤ AMD is building a promising long-term structure, with Elliott Wave analysis pointing to a bullish weekly sequence that started at the April 2025 low. The stock is expected to keep climbing as long as it stays above the September 2025 low. The technical chart reveals a confirmed bullish sequence with clear upside momentum, showing AMD trading well above its previous correction zone and maintaining a solid right-side alignment that signals continued strength.

⬤ Earlier in 2025, AMD completed a major correction phase when the stock hit a large support zone, reaching the 1.0–1.618 extension area before bouncing sharply higher. Since then, the stock has been forming strong upward swings marked as waves ((1)), ((3)), and ((5)), demonstrating solid progress through mid-2025 and into the recent rally. While a brief pullback might occur in the near term, technical analysts expect any dips to hold support and eventually lead to another push higher, completing the five-wave pattern that began at the April 2025 low.

⬤ The September 2025 low represents a crucial support level for AMD's bullish structure. As long as the stock holds above that point, the positive trend remains intact. The technical setup clearly favors the upside, with AMD positioned well above earlier support zones while maintaining strong momentum. This backdrop reflects growing optimism around semiconductor demand and AMD's central position in high-performance computing and AI-driven markets.

⬤ AMD's technical strength matters because the company serves as a bellwether for the broader semiconductor sector and technology momentum overall. A sustained bullish pattern could boost confidence across the chip industry, influence market sentiment, and reinforce expectations for continued demand growth in data centers, AI infrastructure, and advanced processing technologies.

Usman Salis

Usman Salis

Usman Salis

Usman Salis