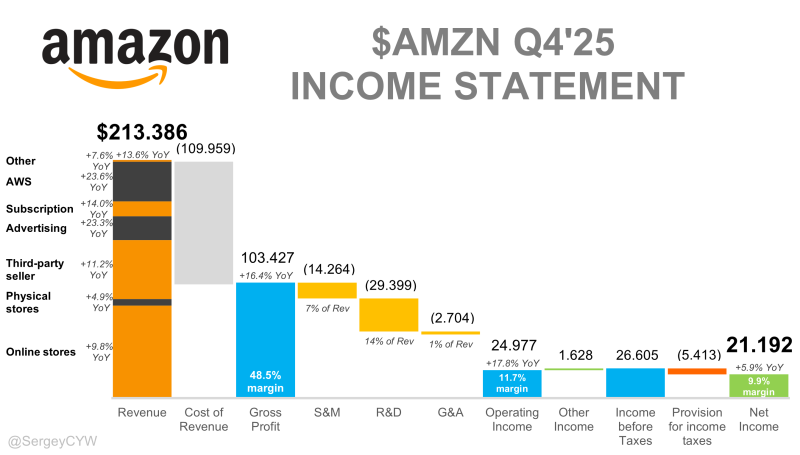

⬤ Amazon just dropped numbers that show the company's firing on all cylinders. Q4 revenue came in at $213.4 billion, a solid 13.6% jump year over year. Operating income hit $24.98 billion with margins holding at 11.7%, proving the company's still printing money even while pouring billions into infrastructure.

⬤ AWS is absolutely killing it right now. The cloud division exploded 23.6% to $35.6 billion in quarterly revenue, putting it on track for a $142 billion annual run rate. The backlog swelled to $244 billion as companies lock in long-term deals for AI and cloud services. Amazon's custom chip game is getting serious too - Trainium and Graviton chips are now pulling in over $10 billion annually. They've already deployed more than 1.4 million Trainium2 chips, and Trainium3 capacity is basically sold out through mid-2026. AWS margins did slip to around 35%, but that's mostly because Amazon's building out AI capacity like there's no tomorrow, not because demand is cooling off.

⬤ The advertising business keeps crushing expectations. Ad revenue hit $21.3 billion, up 23% as Prime Video ads reached roughly 315 million eyeballs and Sponsored Products keep gaining traction. On the retail side, things are humming along nicely - everyday essentials make up about 33% of US orders, grocery sales topped $150 billion, and around 100 million US customers used same-day delivery in 2025. Even international operations finally flipped profitable at 2.1% margins despite ongoing investments in pricing and logistics.

⬤ Here's where it gets interesting. Free cash flow margin dropped to just 2.1% as Amazon plans to drop around $200 billion on multi-year capital expenditure, mostly for AWS AI infrastructure, with even more costs expected in 2026. Demand is clearly there, but whether margins expand from here depends entirely on how fast all this new infrastructure starts generating serious utilization and cash flow.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi