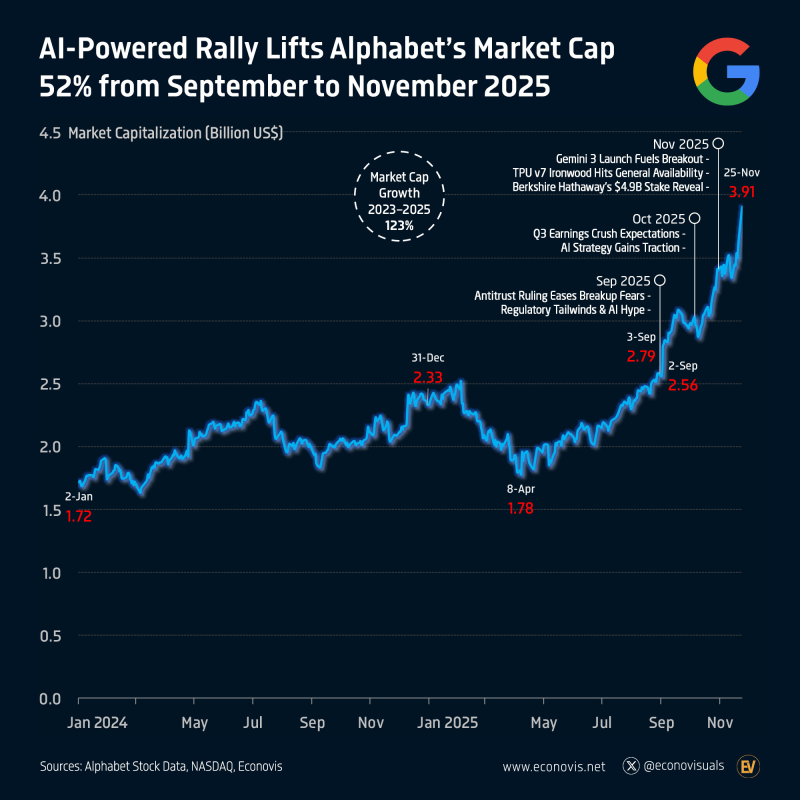

⬤ Alphabet has just finished one of its strongest multi month runs ever. GOOGL shares rose because of real AI progress and better regulatory news. From 2 September to 25 November the company's market cap grew 52.3 % adding about $1.34 trillion for a record $3.91 trillion. The rally accelerated when multiple catalysts arrived at once - earnings results, policy changes besides AI infrastructure steps.

⬤ The move began in early September when an antitrust ruling removed the threat of a breakup. That regulatory relief plus fresh AI optimism lifted GOOGL from $2.56 trillion on 2 September to $2.79 trillion the next day. By 15 September Alphabet passed $3 trillion becoming only the fourth firm to reach that level, after Apple, Microsoft or Nvidia. Late October brought another jump when third quarter earnings beat estimates and the company's AI strategy showed clear traction.

The mix of strong earnings, clearer regulation and faster AI adoption shows how central the AI cycle now is to market leadership.

⬤ A series of major AI advances drove the final leg. On 6 November the TPU v7 Ironwood chip reached general availability giving investors more confidence in Alphabet's growing compute capacity. The pace surged after 18 November when Gemini 3 arrived triggering a breakout that carried GOOGL close to $4 trillion. Berkshire Hathaway's disclosure of a $4.9 billion stake added more buying power through late November.

⬤ Alphabet's push toward $4 trillion matters for the whole market because it shows how fast AI progress can alter mega cap values. The blend of solid earnings, lighter regulation, quicker AI uptake and major product wins underlines how dominant the AI cycle has become in setting market leaders. This rapid expansion signals rising trust in large scale AI infrastructure and strong execution across the tech sector.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah