Stock buybacks have become one of the most powerful tools for creating shareholder value in today's market. Alphabet Inc. ($GOOG) stands as a compelling case study of this strategy in action. Through years of systematic share repurchases, the tech giant has reduced its outstanding shares to levels not seen since 2006, all while profits remain near historic highs.

Key Metrics and Strategy

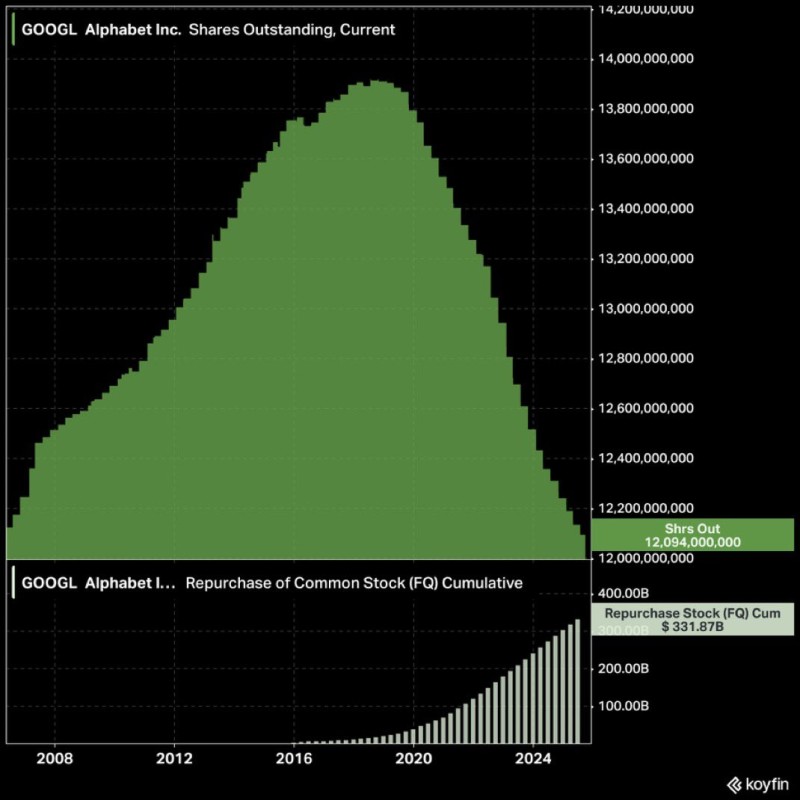

The transformation is striking. After peaking around 2016–2018, Alphabet's share count has steadily declined to just 12.09 billion shares outstanding. The company has invested a staggering $331.87 billion in cumulative stock repurchases—a sum comparable to the entire market value of many Fortune 100 companies.

This reduction in share count has made each remaining share significantly more valuable, driving EPS growth well beyond what revenue expansion alone could achieve. As analyst Bernt Berg-Nielsen observed, while share count has returned to 2006 levels, Alphabet's net income is vastly higher than it was nearly two decades ago, creating a dramatic improvement in per-share earnings.

Why This Strategy Works for Alphabet

Several factors make buybacks particularly effective for Alphabet. The company generates massive cash flow, producing over $70-80 billion annually in free cash flow from its advertising and cloud businesses. This cash-rich position allows management to reduce share count while simultaneously investing in AI development and other growth initiatives. The strategy also signals strong confidence from leadership, suggesting they believe the stock remains undervalued despite its substantial gains.

The Long-Term Impact

The data reveals an inverse relationship between cumulative buybacks and shares outstanding, representing more than financial engineering. This structural shift fundamentally alters long-term ownership dynamics, concentrating future profits among a smaller pool of investors. With outstanding shares back at 2006 levels but net income many times higher, Alphabet demonstrates how strategic buybacks can compound shareholder value over time.

Peter Smith

Peter Smith

Peter Smith

Peter Smith