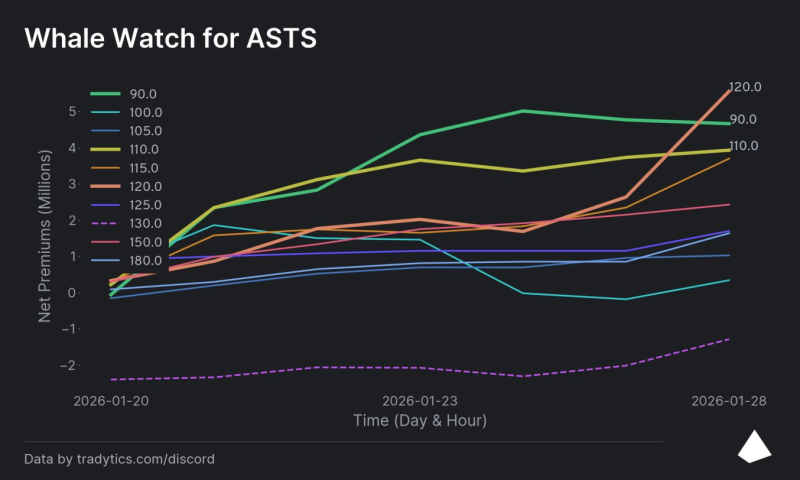

⬤ ASTS options lit up in late January with serious whale action concentrating at a single strike. Net premiums hit roughly $5.5 million, marking a clear shift in how big players are positioning themselves. The data shows a widening gap between strikes, pointing to deliberate repositioning rather than across-the-board interest.

⬤ The 120 strike became the center of attention, with net premiums climbing sharply to about $5.5 million by period's end. This buildup came as other strikes lost steam. The 90 strike, which had pushed close to $5 million earlier, steadily dropped off. The 100 strike flipped negative, while the 130 strike stayed deep in the red, showing capital flowing away from both ends of the strike ladder.

⬤ With ASTS trading around $122, the heavy premium stack at the 120 strike puts whales right at the money. The rotation from 100 to 120 suggests these players tightened their focus to match current price action instead of reaching for higher strikes. Activity clustered near present levels, indicating concentrated engagement within the immediate trading range.

⬤ This matters because premium concentration marks where big money is watching most closely. When whales pile into a single strike, that level tends to anchor near-term price behavior and volatility expectations. For ASTS, the $5.5 million buildup at 120 highlights this strike as a critical reference point shaping short-term sentiment and potential price stability.

Peter Smith

Peter Smith

Peter Smith

Peter Smith