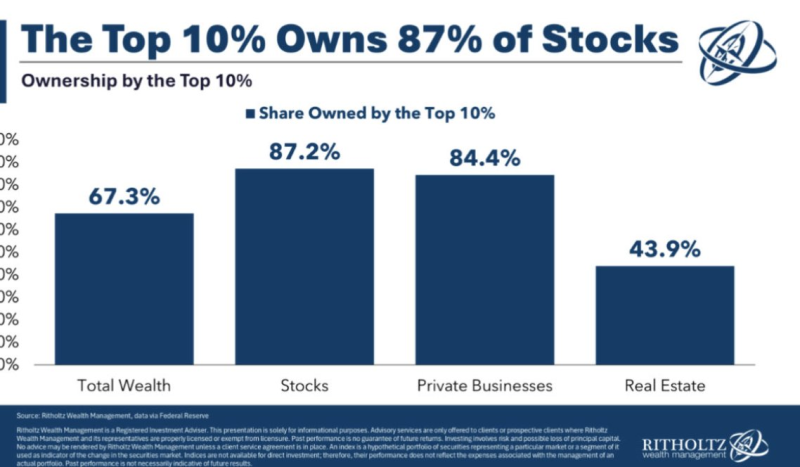

⬤ Fresh numbers from Ritholtz Wealth Management show just how concentrated wealth has become in the United States. According to an unusual_whales tweet, the top 10% of American households control 87% of all stocks, nearly 85% of private businesses, and 44% of real estate. A chart titled "The Top 10% Owns 87% of Stocks" breaks this down category by category, showing exactly how much the wealthiest decile owns in each asset class.

⬤ Here's the breakdown: the top 10% hold 67.3% of total wealth, 87.2% of stocks, 84.4% of private businesses, and 43.9% of real estate. The chart, which pulls data from the Federal Reserve via Ritholtz Wealth Management, makes it easy to compare ownership across these categories. Stocks are the most concentrated, followed closely by private businesses, while real estate is somewhat more spread out—though still heavily tilted toward the top.

⬤ The visual tells a straightforward story: stock ownership is overwhelmingly concentrated at the top, with private business stakes showing a similar pattern. Real estate ownership is more distributed than stocks, but the top 10% still controls a hefty chunk. The numbers in the chart match what the tweet highlights, giving us a quick, clear snapshot of who owns what in America.

⬤ Why does this matter? Because when the stock market moves—up or down—it's mainly the top 10% who feel it, since that's where most stock ownership sits. This concentration shapes how wealth effects ripple through the economy. Changes in stock prices, private business values, and real estate markets hit this group first and hardest, which then influences their spending and investment decisions—and ultimately, the broader economy.

Usman Salis

Usman Salis

Usman Salis

Usman Salis